If you are not served with the Summons and Complaint in a collection lawsuit, then a default judgment entered against you in that lawsuit is void. That was the point I made to the Mobile County Circuit Court at a hearing on my Motion for Relief from a default judgment on July 11th. My client had apparently been sued by Credit Acceptance Corp. back in 2010. They were unable to serve process (meaning deliver a copy of the lawsuit papers) upon her directly, so they sent a copy by certified mail to the address they had on file for her. The U.S. Postal Service delivered it and someone signed for delivery.

The collection attorneys filed a copy of the signed return receipt with the court and moved for a default judgment. It was granted without opposition. There was one problem, though: my client didn’t live at that address. She had lived there briefly back in 2006, but had long since moved away. So the person who signed for it was not capable of receiving service for her.

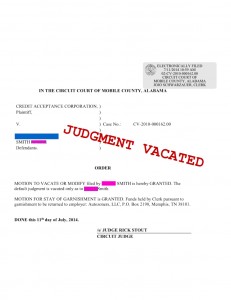

She didn’t even know about the judgment until one day out of the blue, her paycheck was missing some of its dollars. She found out that she’d been garnished on a judgment she never knew existed. So she came to me for help. I filed a motion for relief from the judgment. It was granted and now my client will have her chance to defend herself from this suit.

Normally, default judgments are permanent. They are only reversed in specific circumstances, and if the complaint was received by an adult at your address, or someone who is your agent (like a spouse), you’re stuck with it. But when you can show that you’ve never been served with the complaint in the first place, your constitutional right to due process of law provides that you can reverse the default judgment and get your day in court.

Please help me capital one has been harassing me for 2 years with there default judgement against me that I never knew about until I was served with garnishment papers. I fought it and fought it They froze my bank account even after I had a order of protection. The judge threw it out and capital one sent me a 1099 in 2014. Now here we go again just got another paper saying they are serving my employer with garnishment papers I don’t see how what they are doing to me is legal. I need a good lawyer to help me.

That doesn’t sound right. You should call a lawyer in your area who deals with consumer rights cases. If you live in Alabama, call us and we can discuss your legal options.