Counterclaims under Truth in Lending Act Convinced Autovest to Dismiss their Case

Though there are countless ways to attack a collection lawsuit, most cases come down to a simple lack of evidence on the collector’s part. But this case was a bit different. My clients were sued by a debt buyer called Autovest, LLC. As I’ve written before, Autovest is a Michigan company that buys charged off repossession deficiencies and sues consumers for the debts. Auto loans are subject to a number of defenses and possible counterclaims because

a) repossessions are subject to lots of abuse by careless and rude repo men, giving potential counterclaims under the UCC Article 9 and

b)car dealers are so sloppy and errors in loan origination are very common. This can give you counterclaims under the Truth in Lending Act.

In this case, my clients were sued for an old car loan, and after looking over the dealer sale documents, I noticed some clear discrepancies and omissions on the TILA disclosures. So in addition to filing my answer, I filed a counterclaim under Truth in Lending Act.

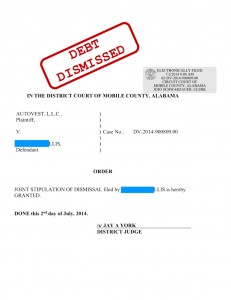

Rather than litigate all this, the collector just decided to waive their claims if we agreed to waive our counterclaims.

So we filed a joint stipulation of dismissal, and my clients are debt free.

Total savings: $4,707.

Leave a Reply