We fight debt collection lawsuits all the time, so it’s hard to keep track of all the cases we’ve handled. But here are a few recent ones that we’ve taken to trial and won.

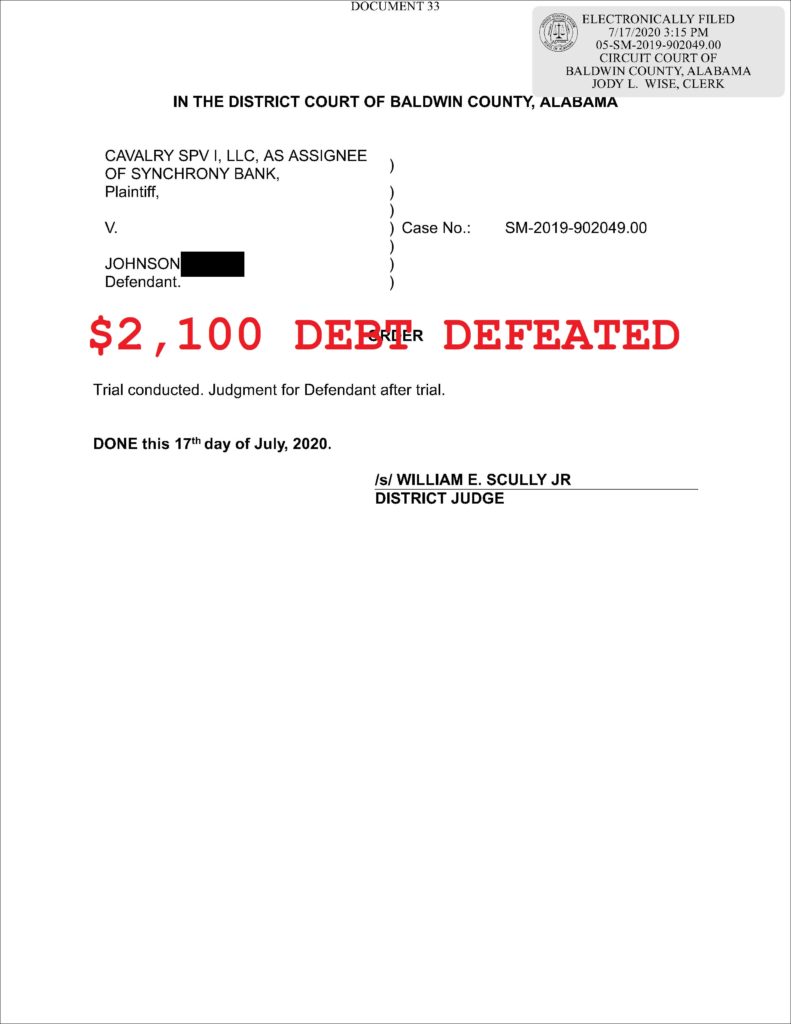

First, Cavalry SPV I, LLC v. Johnson – Baldwin County, Alabama debt collection lawsuit based on a credit card account that our client did not recognize. We answered that the plaintiff lacked standing and that the account was the result of identity theft. We took it to trial and won.

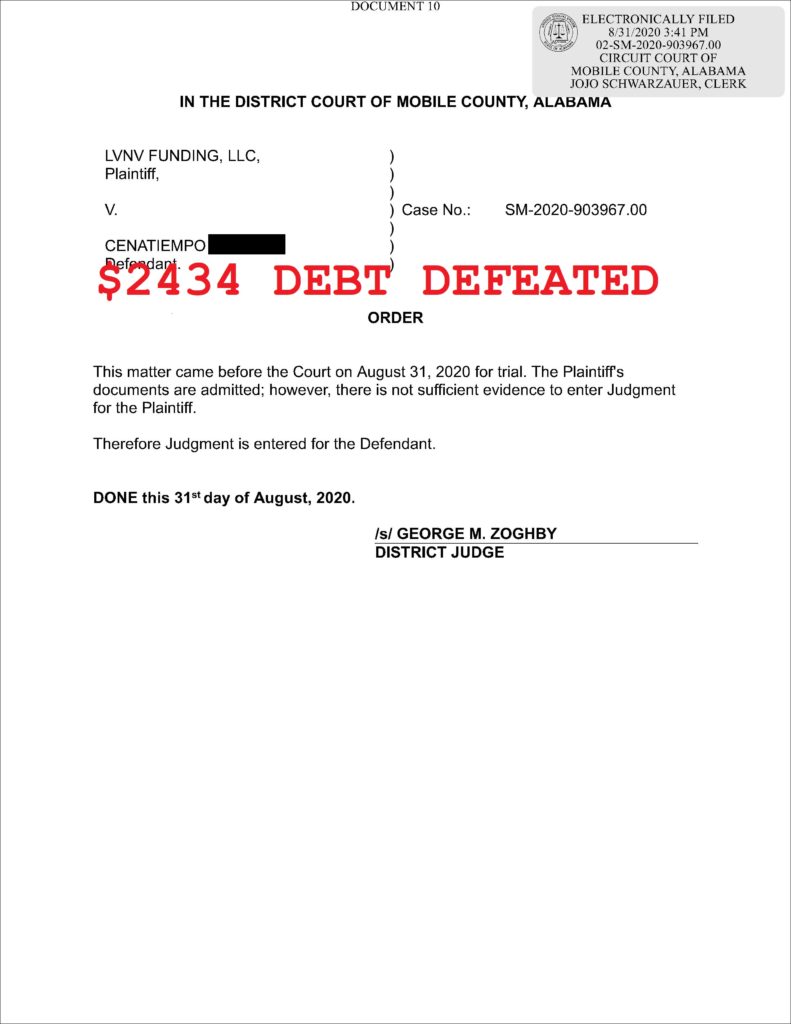

Next, LVNV Funding, LLC v. Cenatiempo. Our client was sued by LVNV Funding, a debt collector owned by Resurgent Capital out of South Carolina. They alleged that he owed them for a $2400 Credit One Bank credit card. We answered the lawsuit, denying the allegations and demanding a trial. We went to trial in August 2020 and won.

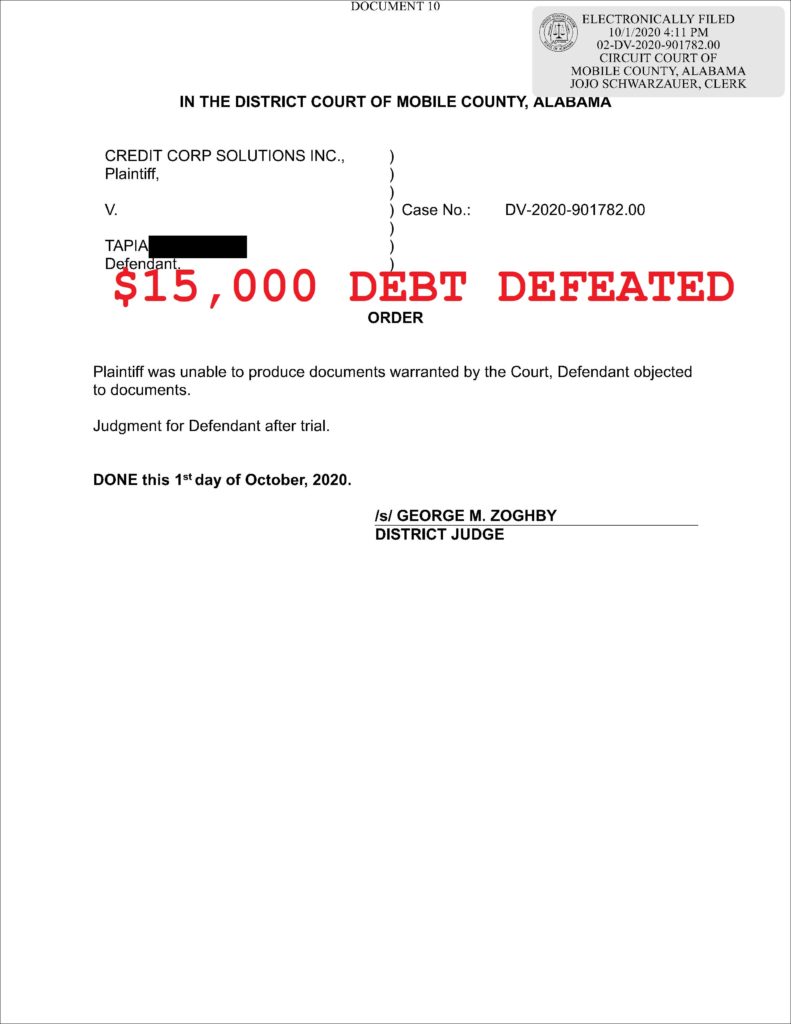

Third, we have Credit Corp Solutions, Inc. v. Tapia. Credit Corp Solutions, Inc. is a debt buyer based in THE PHILLIPINES! But they’re registered in Alabama as a Delaware corporation. They sued our client for $15,000, based on an allegedly unpaid loan from BBVA Compass Bank. We answered, asserting a number of affirmative defenses and demanding a trial. The judge gave us a trial in October 2020 and we won.

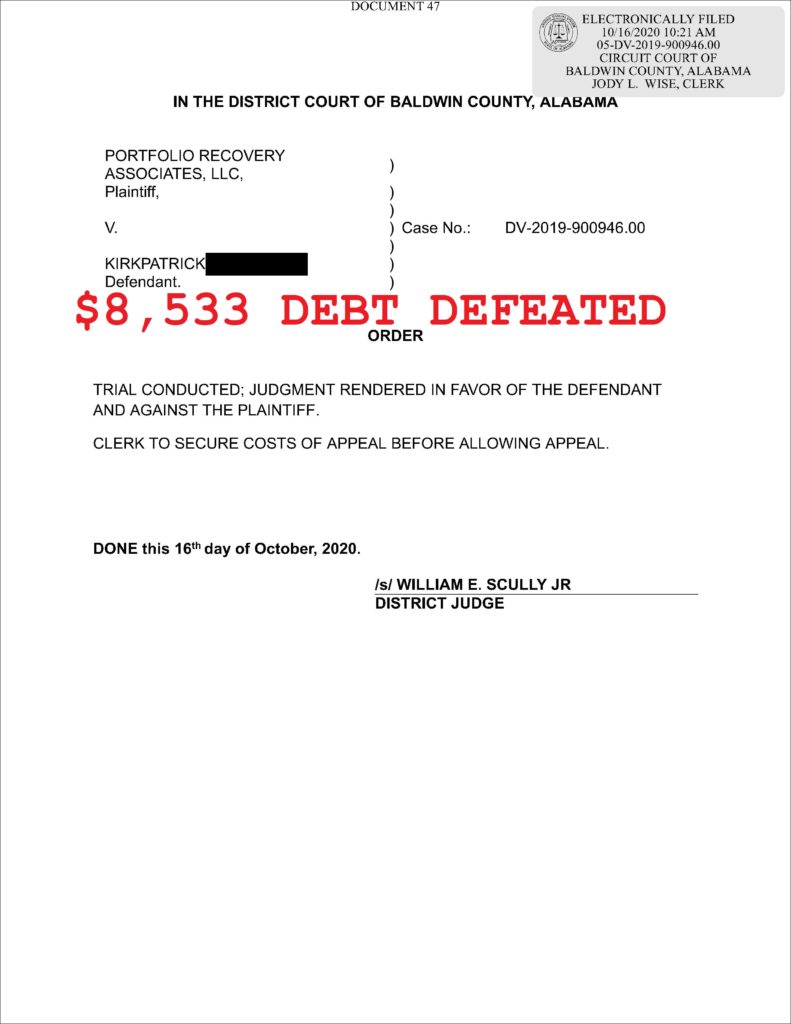

Finally, we have Portfolio Recovery Associates, LLC v. Kirkpatrick. Portfolio Recovery Associates is a HUGE debt buyer based in Virginia. They purchase accounts all over the country, and sue thousands of people in Alabama. In this case, PRA sued my client for $8,533, which they claimed she owed them for an old Capital One credit card. We answered and asserted a few affirmative defenses. It finally got to trial on October 21, 2020, and we won.

Perhaps most importantly, all of these clients have been able to AVOID BANKRUPTCY. We continue to defend Alabama consumers from debt collection lawsuits all across the state. If you have received a summons and want to talk about it with a real lawyer who knows how to handle these cases, call us today. The consultation is free.

I bought a truck for my husband for Christmas last year. At a buy here pay here car lot, in Sardis Alabama. Close to Boaz Al. About 45 minutes North of trussville. So, you know where I am

at.😊 Anyways, so I buy this truck for my Husbands Christmas last year. And the salesman and the his boss ensuring me that if something is wrong with it they will fix it. This conversation lasted about 15 min or so. Because, I wanted to know without a doubt that they would take care of any immediate problems that should arise during that time. And Mr David assured me they would in fact fix it if anything came up during that time. So, I went ahead with the purchase. To this day I have been paying for this truck they have yet to fix. Multiple attempts them telling me as soon as he can get a mechanic to get to it he will. He just kept putting me off over and over well. I got behind on my payment and it was repossessed. So, I go pay and get the truck back and let him know I’m sorry it got behind as I have been in and out of the doctors and hospitals to find out if I have cancer. And that we really need the truck fixed. Because driving a truck that has issues that go unfixed causes more issues. And it’s hard to pay $20,000 for a vehicle you can’t drive. At this point he has lost his mechanic. Who quit on them because of what they where doing to customers come to find out. But, Mr David the car lot manager ensures me yet again that as soon as he gets a mechanic they will fix it. So, I pay the late fees and repo fees to get the truck back. And ask the receptionist to make a note so David don’t forget. She said she would. I also reminded her of all my upcoming Doctor visits and that if I get behind, that they know me I might be late but I always pay. We both smile and she says oh yeah yeah, your good. I say I know but, I don’t want it to get repossessed again. She says oh no your good. I asked her to please call me before hand so, I can pay before that happens. And remind her of upcoming Dr. Appointments.

We leave and 2 weeks go by 3 weeks still no mechanic. So, at this point my husband and I are trying to figure out what to do what our rights are? And during this time used truck prices sky rocket. And they repossess it as I am a little over 1 month behind with no notice or anything we go up there and Mr David comes out and he ends up chest bumping my husband and swings a punch at my husband and then my husband defends himself and that situation got escalated. I believe it boils down to the price/resale value on trucks right now. So they wanted the truck back for resale.

Hints the refusal to fix it. Trying to force us into letting it go back. I believe this because it is my second vehicle from them. And I have been late before and no problems. But, now used trucks are really high in value. So, they have bullied up the whole time almost. As the price on used cars went up right after purchasing. But recently they have gone even higher. I really hope you can help me. @Cschilleci3@gmail.com

Crystal,

The dealer’s obligation to repair the truck depends on whether or not he provided a warranty in the contract paperwork. If no promises were made about the condition of the truck, he may not have an obligation to fix it. You’ll need to have an attorney look over the paperwork and tell you what your rights are.

I am being sued by Bleeker Brodey & Andrews on behalf of Opportunity Financial LLC. I have responded to the summons and denied owing the debt. The debt is from April 2019 and it is a personal loan with a balance of 2717.00. The interest rate is 160%. I dis not live at the address they have on file during the time the loan was taken. I was hoping for some advice on what I should do as I have a court date on September 6th 2022?? Thanks in advance.

I just received a paper that BBVA is suing me for $2500 from May 2019 that I don’t owe. I’m suppose to go to court in October. I dont have a card with them and the address listed is super old and I hadn’t lived at that address in 6 years. Help

If you truly don’t owe the money, then you need to fight them in court.