Last year, the Consumer Financial Protection Bureau decided to finally get around to regulating sketchy car dealers and other non-bank arrangers of consumer financing.

Why? Because as everyone who deals with auto dealers and their financing partners knows, car dealers very often conceal important facts from the people they deal with. In this particular case, the CFPB was concerned with the way that dealers will hike up interest rates or other finance charges for borrowers who seem unsophisticated or ignorant, and lie about it. Here’s a great and common example: you go to a dealership and find a car you like. You’ve run your credit before, so you believe that you can be approved for about $18,000 of financing at 12% APR. After hours at the dealership going through paperwork and waiting while they make phone calls and work on computers, they present you with paperwork. But to your surprise, the price is $19,000 and the APR is 18%. You say “That seems a bit high!”

“That was all the bank would approve. We checked with 6 different finance companies, and that was the best deal we could find you.”

Of course, this is a lie. The truth is that they are trying to direct you to the finance company that provides the best deal for them – the one that will pay them the most for the contract. And since they pay more for contracts with higher rates relative to the creditworthiness of the buyer, they’re steering you to possibly the worst deal of the 6 companies, and they could have found you a 13% APR.

There is nothing illegal about making a profit. There is nothing wrong with not telling a buyer how much they paid for the car they’re selling you. That’s part of the deal. But there is something wrong with lying to people. When they say: “This is the best deal we could find” that should be the truth. If they want to profit, they should do it like the rest of us by buying things at a low value and selling them at a high value. So the CFPB wants to require them to be more honest.

Naturally, they don’t want to be more honest because that means they’ll be forced to – GASP! – give people fair deals! So they called their lobbyists in Washington and had them pester our Congressional representatives to try and stop the CFPB from helping out working folks. What happened?

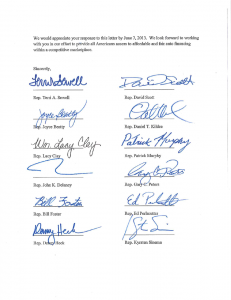

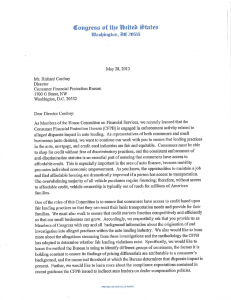

13 House Democrats signed a letter demanding that the CFPB provide copies of all data used in determining that sketchy car dealers were lying to people about getting kickbacks from finance companies. Here is their letter:

Page 2. There are 13 signatures in all.

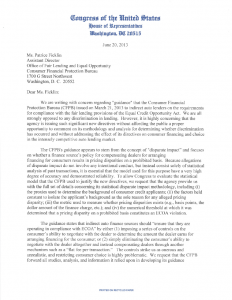

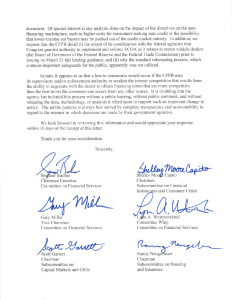

By contrast, here are the letters from the Republicans.

Obviously, the Republican response was more pro-business and anti-consumer. No surprise there. And the way the Republican letter linguistically distorted the facts by using words like “control” and “restricting consumer choice” indicates that the letterw as probably written directly by the auto dealer lobbyists, not the Representatives themselves. That shows you just how much these 35 particular Congressmen are deeply in the pockets of the industry.

But the Democrat response is just as bad. Why? Because it shouldn’t have been written in the first place. There’s a reason only 6.5% of House Democrats signed on. Republicans make no secret of favoring businesses over people. It’s their raison d’etre.

Whose side are they on?