Ever wonder what all that fine print in your car purchase contract means? Here’s a basic explanation. Warning: when you are done reading this, you will learn that you have been screwed before.

If you’re like most people, when you want to buy something or enter into some sort of deal, you get presented with some massive, multiple page form contract filled with fine print and unintelligible words and phrases. Fine print contracts of adhesion are everywhere. We’re used to them. If you don’t live on a farm in the woods with no sort of insurance or communication services and get around on horseback, then you’re stuck with hundreds of them every year. And since they’re not only mandatory but also basically indecipherable, you probably don’t bother reading them.

But in case you’re curious just what exactly you’re agreeing to, here it is:

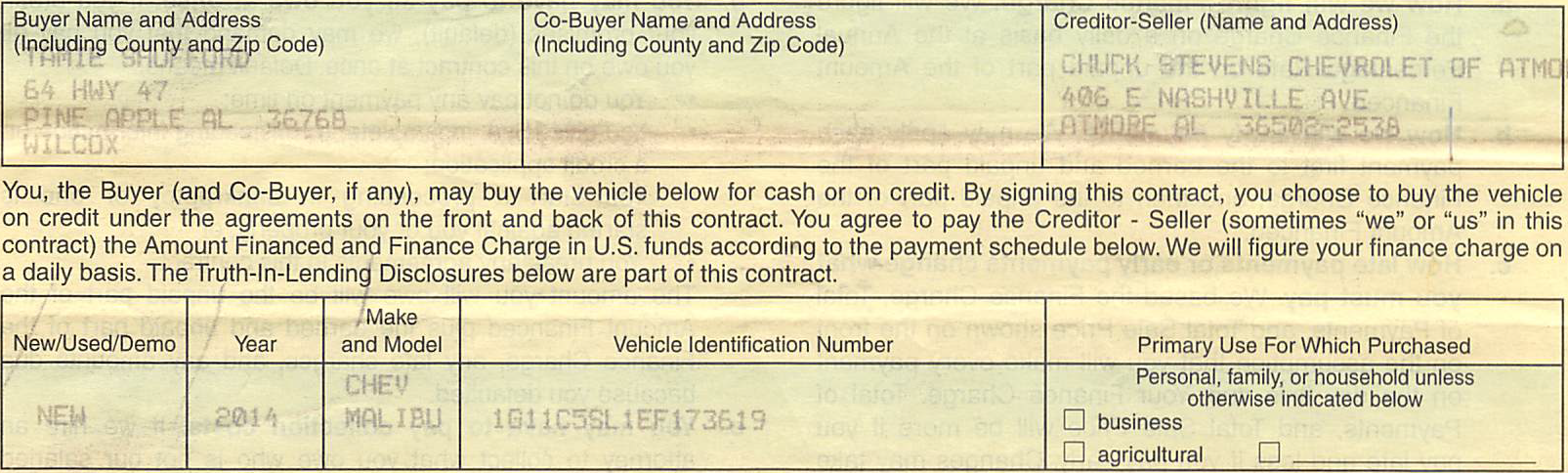

I. The Basic Sale Language. Ripoff Rating: 0/10. – This identifies the parties and the goods being sold. Real simple, and very necessary.

II. The TILA Box. Ripoff Rating: 0/10. The Truth in Lending Act requires the seller to not only state the price of the goods, but also the cost of any credit charges associated with the transaction. They also must itemize every charge that was financed. This is also very necessary, because without it you wouldn’t know what you were paying and why.

ALWAYS examine this box thoroughly, because most of the charges here are entirely optional. This is where they have to list any doc fees, credit life or disability insurance premiums, GAP insurance premiums, service contracts, extended warranties, etc. There are two important things to know about these charges:

- You cannot be required to purchase these things. If you see them on your contract and you don’t want to waste thousands of dollars that you don’t have to spend, you can and should ask the dealer to rewrite the contract to remove everything but doc fees and Tag/Title fees, which are $16.50 in Alabama.

- You are being overcharged for these things. Dealers add hundreds of dollars to the prices of these extras and pocket the money. For instance, if a GM extended warranty costs $1,000, the dealer won’t tell you that, but will just write it up with a cost of $1,500. The dealer gets to keep the difference, while you’re paying that money back with interest. This used to be considered fraud, but our super-conservative AL supreme court decided in the 1990s to let dealers off the hook. It remains a huge profit source for them.

That concludes the part of your contract that is actually useful and necessary. Everything else is utterly worthless to you as a buyer, and is designed solely to give the dealer more money and privileges while depriving you of as many rights as the law allows. This isn’t hyperbole. It’s life in the modern American economy in a conservative state.

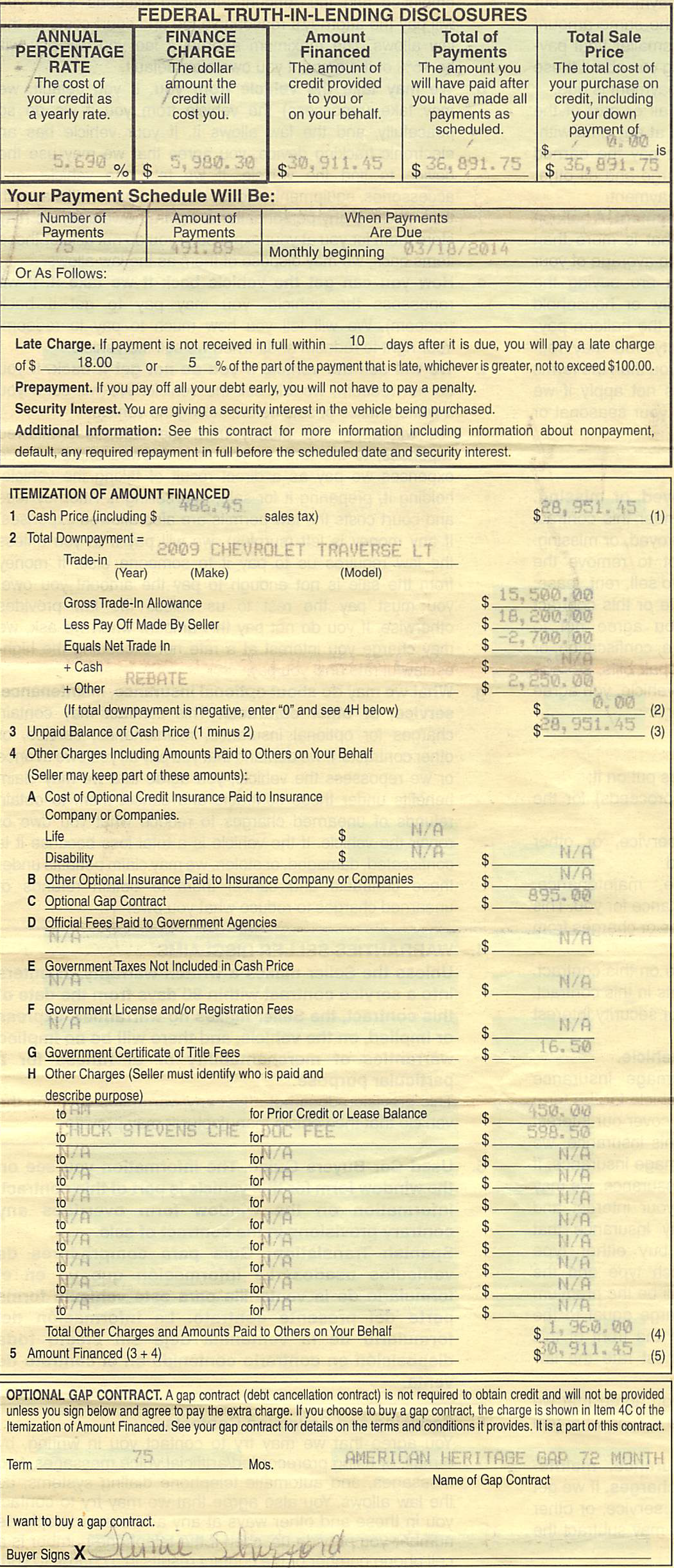

III. GAP Contract Box. Ripoff Rating: 3/10. This is where you can agree to pay extra money to the dealer for a virtually worthless service. I don’t care what the salesman tells you. It’s a ripoff.

IV. No Cooling Off Period. Ripoff Rating: 3/10. Pretty Self-Explanatory. Once the deal is signed, you can’t bring it back, even if the salesman promises otherwise.

V. Interest Rate Skimming Notice. Ripoff Rating – 7/10. This short little disclaimer warns you that the interest rate on your contract is probably higher than the interest rate that the finance company was going to charge you. How does this work? Easy. You fill out a credit application at the dealership. They send it to multiple finance companes to “find you the best deal.” They get a few responses almost instantly, based on your credit, income, and other information. Bank A says they’ll finance the deal at a minimum of 8% APR, with a monthly payment not to exceed $300. Bank B says they’ll finance the deal at a minimum 8.5% APR, with a monthly payment not to exceed $350. The dealer says, “You’ve got some problems on your credit, but we worked hard and pulled a few strings and got you approved at $325/month with Bank B. That’s a good deal, buddy.” Not knowing any better, you agree, and they fill out a contract with an interest rate of 12.75%. They didn’t tell you that Bank A would have financed the deal at 8% with a monthly payment of $287. And this little 2-liner lets them off the hook if you later discover that they were lying to you.

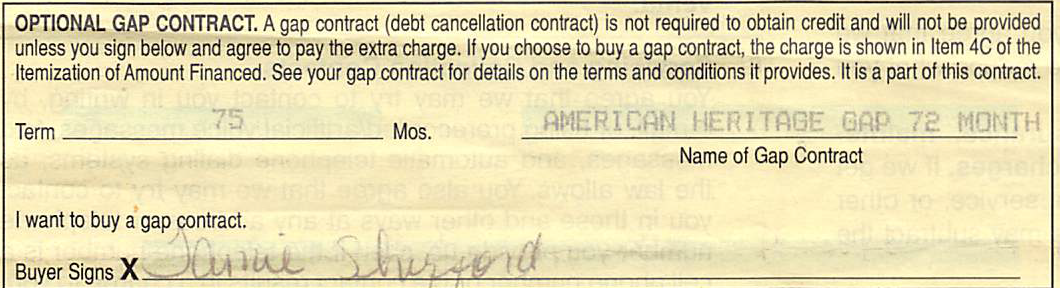

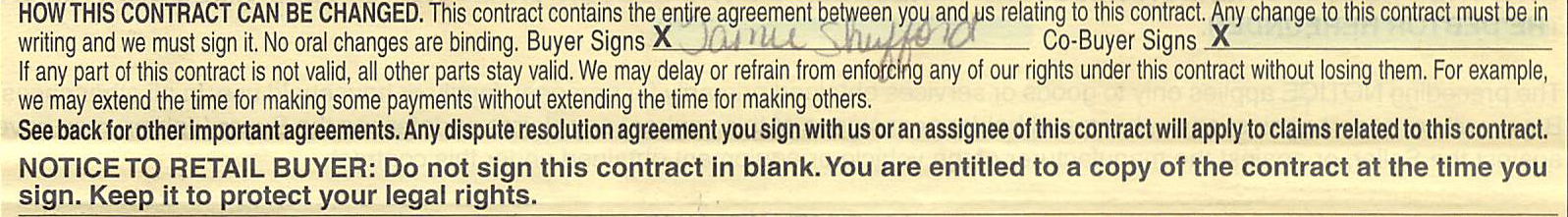

VI. Merger Clause. Ripoff Rating: 7/10. This says that the paperwork is the entire deal. Sounds innocuous, right? But what it means in the courts is that nothing anyone told you matters at all once you sign this contract. So the salesman could promise 38 mpg mileage, that the car has 266 HP, that it’s never been wrecked, that you can bring it back tomorrow if you don’t like it, that the financing you got was the best they could find, or basically anything else, and even if he is lying through his teeth, you can’t do anything about it.

It also is designed to get finance companies off the hook if they promise to let you make a payment 2 days late, accept the payment, and then repo the car anyway.

VIII. Read-This-Contract Notice. Ripoff rating: 4/10. This is legally mandated warning that you should read this contract before you sign it. By signing it, you are basically saying that you read the whole thing and understood it, even though that’s obviously false for 90% of the American public. You’ll be held to this if you ever make it to court. It also incorporates any arbitration agreement that may be attached to this deal. Which accounts for its ripoff rating.

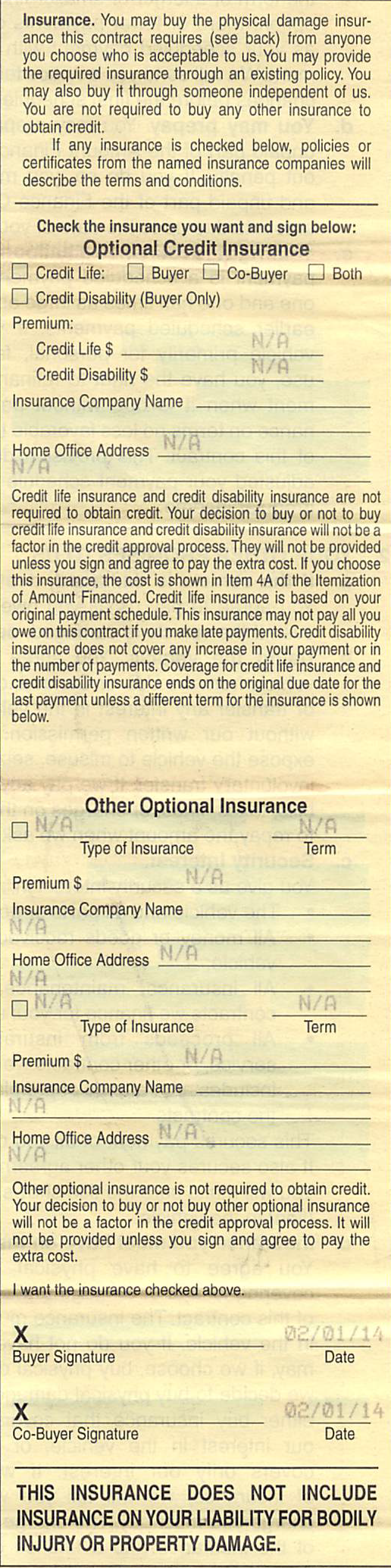

IX. Optional Insurance Box. Ripoff Rating: 4/10. If you were conned into buying some credit life or disability insurance, this is where you sign to agree to it. Please don’t sign it. If you’re just feeling generous, give your money to a charity instead. Or go out to eat and leave a good tip.

X. Assignment Block. Ripoff Rating: 0/10. This is where they write the name of whatever finance company they sell the contract to. No big deal. It doesn’t change the terms of the deal in any way.

That concludes our analysis of the first page of a typical retail installment purchase agreement for a motor vehicle in Alabama. Next, we’ll talk about the back of the contract.

Leave a Reply