We fight debt collection lawsuits all the time, so it’s hard to keep track of all the cases we’ve handled. But here are a few recent ones that we’ve taken to trial and won.

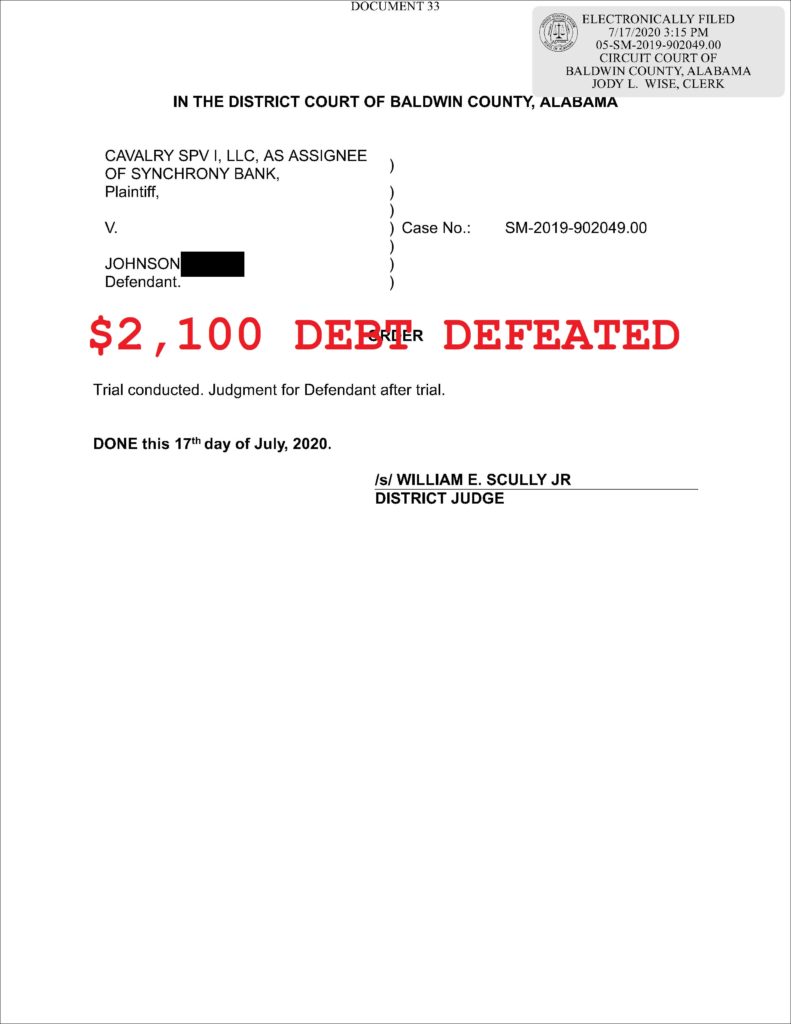

First, Cavalry SPV I, LLC v. Johnson – Baldwin County, Alabama debt collection lawsuit based on a credit card account that our client did not recognize. We answered that the plaintiff lacked standing and that the account was the result of identity theft. We took it to trial and won.

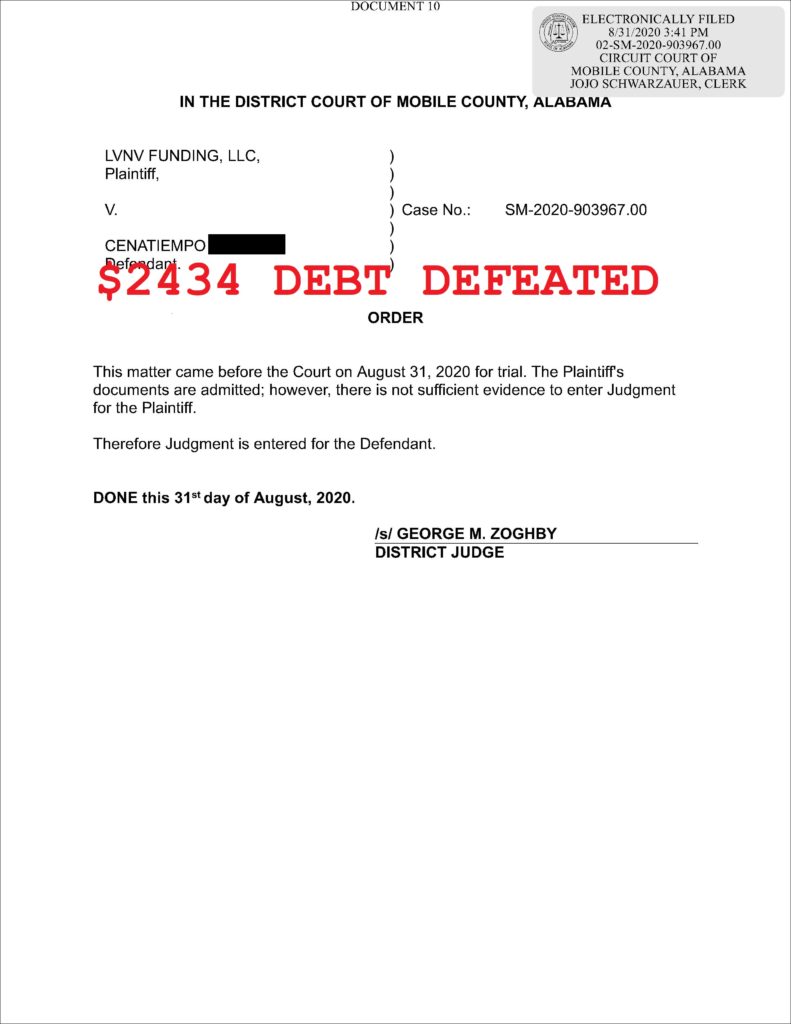

Next, LVNV Funding, LLC v. Cenatiempo. Our client was sued by LVNV Funding, a debt collector owned by Resurgent Capital out of South Carolina. They alleged that he owed them for a $2400 Credit One Bank credit card. We answered the lawsuit, denying the allegations and demanding a trial. We went to trial in August 2020 and won.

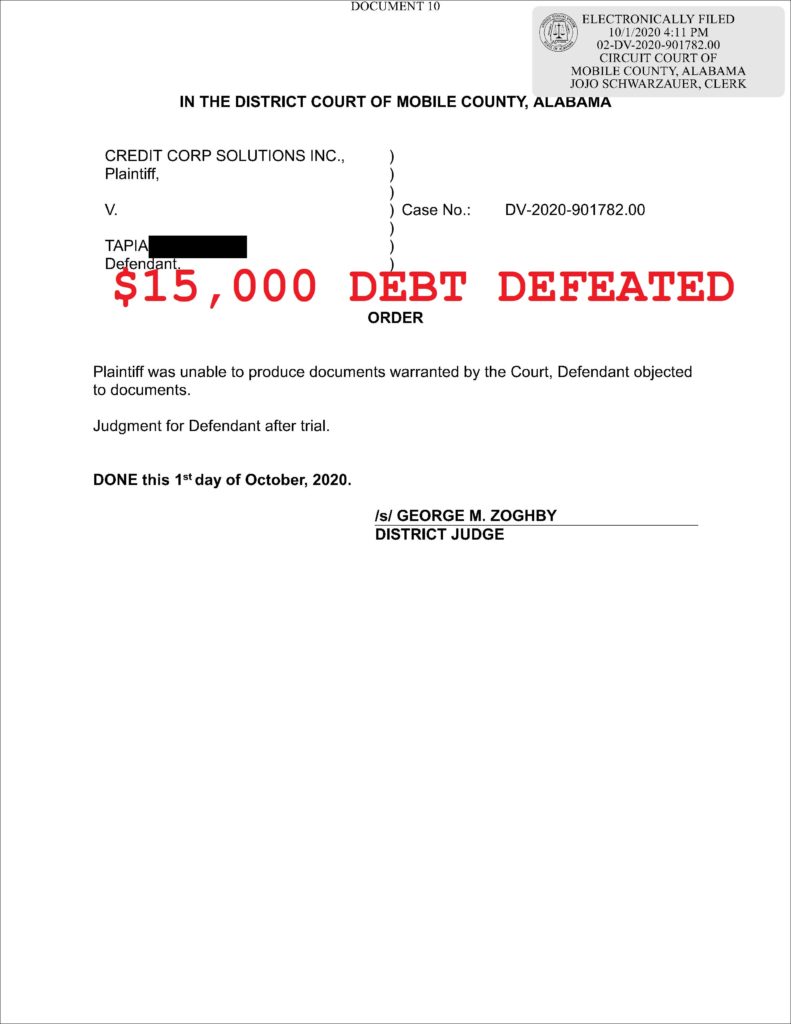

Third, we have Credit Corp Solutions, Inc. v. Tapia. Credit Corp Solutions, Inc. is a debt buyer based in THE PHILLIPINES! But they’re registered in Alabama as a Delaware corporation. They sued our client for $15,000, based on an allegedly unpaid loan from BBVA Compass Bank. We answered, asserting a number of affirmative defenses and demanding a trial. The judge gave us a trial in October 2020 and we won.

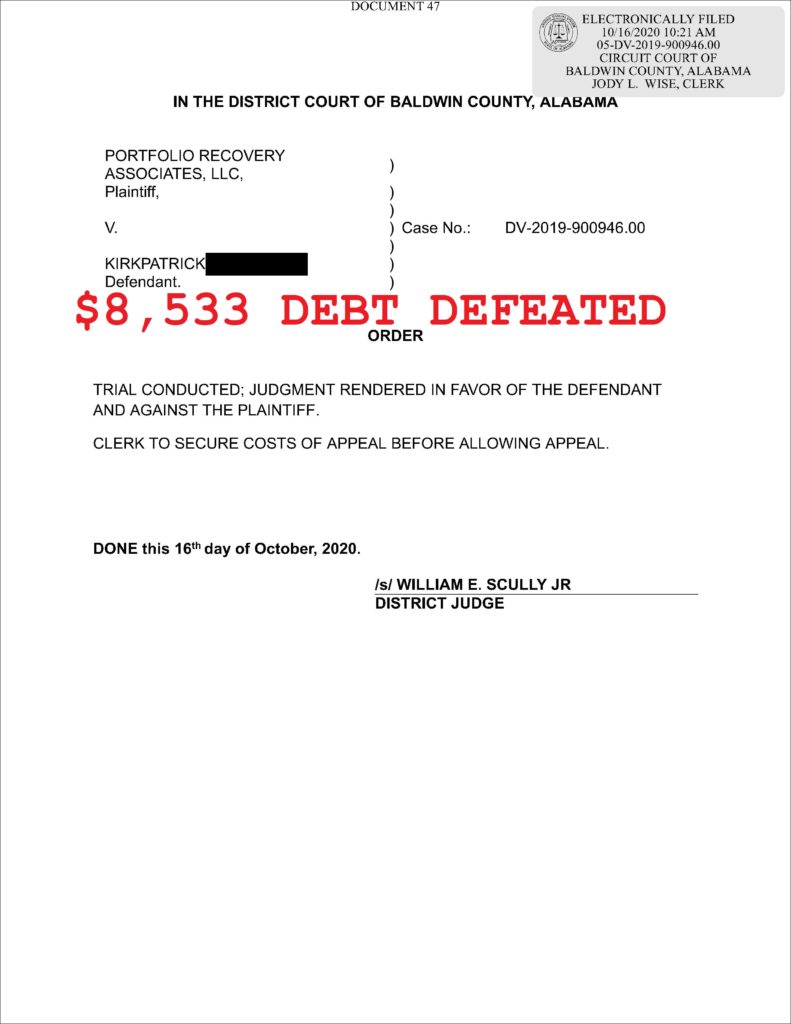

Finally, we have Portfolio Recovery Associates, LLC v. Kirkpatrick. Portfolio Recovery Associates is a HUGE debt buyer based in Virginia. They purchase accounts all over the country, and sue thousands of people in Alabama. In this case, PRA sued my client for $8,533, which they claimed she owed them for an old Capital One credit card. We answered and asserted a few affirmative defenses. It finally got to trial on October 21, 2020, and we won.

Perhaps most importantly, all of these clients have been able to AVOID BANKRUPTCY. We continue to defend Alabama consumers from debt collection lawsuits all across the state. If you have received a summons and want to talk about it with a real lawyer who knows how to handle these cases, call us today. The consultation is free.