If you have received a “Notice of Electronic Filing” from the Alabama court system with the name “Jefferson Capital Systems, LLC,” you are probably being hounded for an old credit card debt.

Jefferson Capital Systems, LLC is a debt buyer based in St. Cloud, Minnesota. Like most debt buyers, they seem to purchase large porfolios of old charged off credit card debt for pennies on the dollar, and then try to collect that debt. Jefferson Capital frequently files collection lawsuits against consumers and debtors in Alabama, and I have dealt with them on numerous occasions.

When they actually go to court, debt buyers like Jefferson Capital often have a difficult time actually proving that they have the right to collect anything, but that doesn’t stop them from trying. For one thing, most people don’t even respond to a credit card lawsuit, because they think that they don’t have a chance of winning. Nothing could be further from the truth. You always have a chance of winning and you should always conslut an experienced debt defense attorney if you’re facing a collection lawsuit from Jefferson Capital Systems.

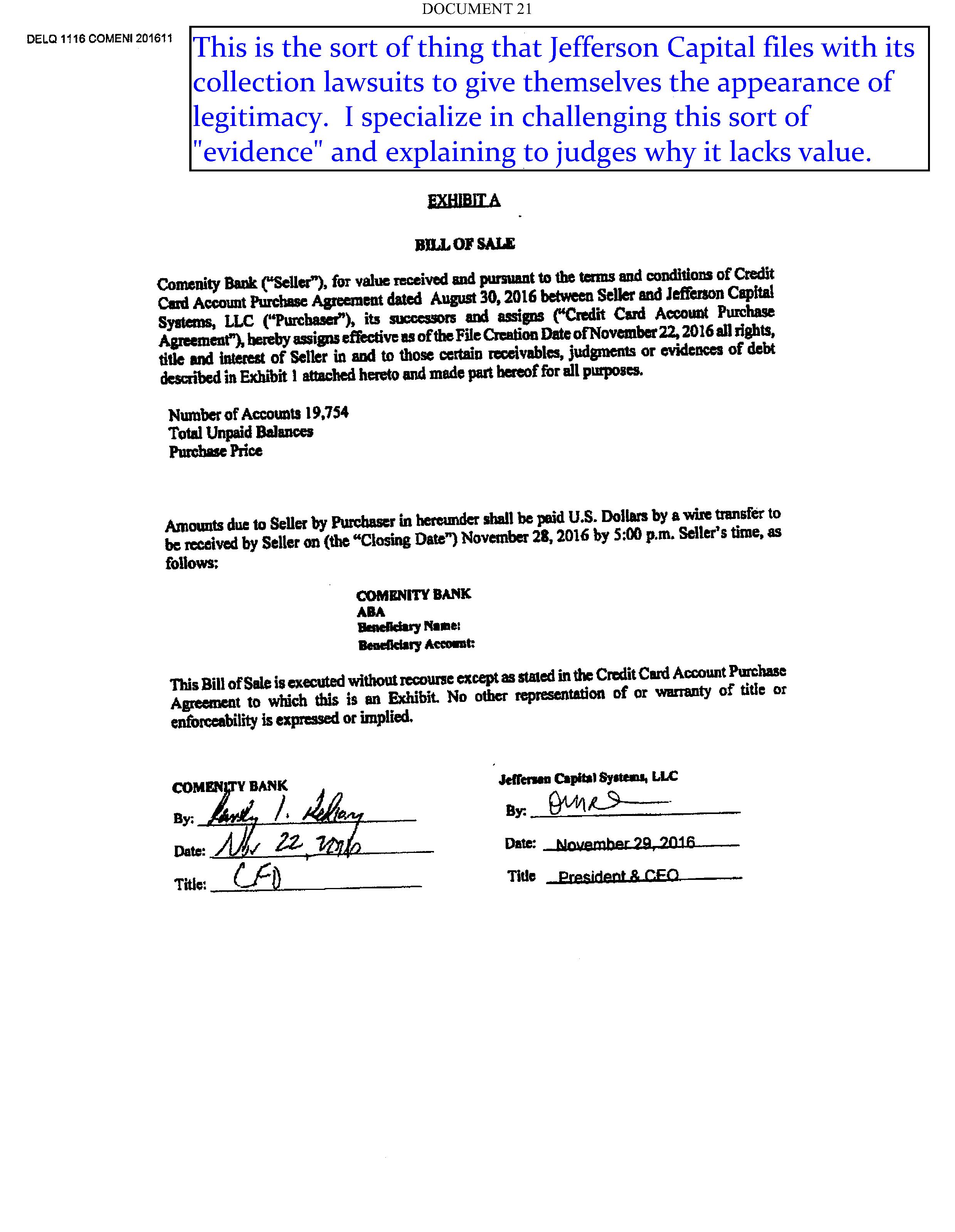

But they do a very good job of convincing people that they are legitimate and that they have the right to sue you. Here’s a typical example of the sort of documents they may show you or provide to a court to prove their standing to sue you:

The most important thing to remember when dealing with debt buyers, including Jefferson Capital, is that you should take every lawsuit against you seriously, and you should definitely talk to an experienced debtor’s rights attorney to help you deal with this. Our fees are reasonable and our track record is proven. If you’ve been sued in Alabama by Jefferson Capital Systems, feel free to give us a call at 251-272-9148.