Autovest, LLC Sued my client for a deficiency balance owed after her car was repossessed. We beat the lawsuit by showing that the suit was illegal due to the passage of the Statute of Limitations.

My client had in fact owed money to Wells Fargo Financial Acceptance for a 2007 Dodge Magnum she had purchased back in April 2007. But as often happens, the car broke down and when the dealer wouldn’t fix it, my client had to find new transportation. She couldn’t afford to pay both, so she stopped paying in May 2009 and the car was repossessed in May 2010. For 4 years, nothing happened.

Then, in June 2014, my client received a summons from some company called Autovest, LLC, relating to a lawsuit in the Circuit Court of Mobile County, Alabama. She had never heard of Autovest, and had no idea who they were. She certainly had never entered into any contract with Autovest. So who are they?

Autovest is a debt buyer located at 26261 Evergreen Rd, Suite 390 Southfield, MI 48076. They purchase charged off accounts from creditors who no longer wish to collect them. In this case, they claimed that Wells Fargo Financial Acceptance had assigned my client’s auto sale contract to Autovest, and that by virtue of the assignment, they had the right to sue my client.

She came to my office and naturally she was very upset. After all, they were asking the court to force her to pay them almost $10,000 and she had no idea what to do about it. But when showed me the paperwork, I saw an immediate problem: they were too late.

See, if someone owes you money, you cannot wait forever to take them to court. The law places a time limit on every lawsuit. It’s called the Statute of Limitations. For most contracts in Alabama, the statute of limitations is 6 years. But on a contract for the sale of goods, we have a different rule: the statute of limitations is 4 years. Why? Because sales for goods are subject to a special rule in the Uniform Commercial Code: Article 2, Section 725.

A vehicle sale contract – even one where the car purchase was financed over a 60 month installment contract, is still a contract for the sale of goods. And in this case, the collector waited until more than 4 years after my client’s last payment to sue her. In fact, they waited longer than 4 years after the car was repossessed. This was undisputed.

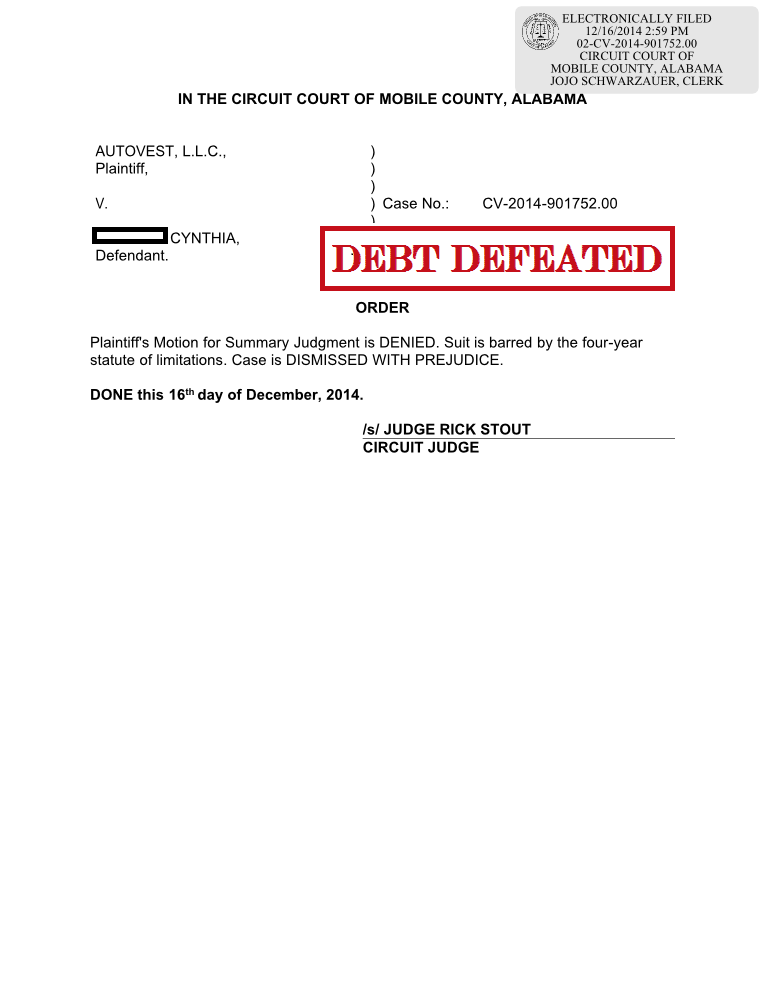

Well, you can’t do that. The law is clear. If you want to sue on an retail installment sales agreement, you better do it in 4 years. The court agreed with me.

See:

My wife and I are going through a very similar deal like the story posted here.we had a 2005dodge strattus financed through Wells Fargo it was repossessed in 2008.and then in 2012 we got our first court papers.from this company called autovest.and the car loan was originally about 12,000 dollars.and now today November 9th 2015.we just got more ct papers again from autovest.and they are now wanting over 20,000 .and have been trying to garnish us.and even tried to take our posessions .we have never heard of this company either.and so we are still suffering almost 8yrs dealing with this company.we r both on a fixed income.and can’t even afford to do bankruptcy.we would very much like some kind of help in this matter.we r at r witts end.please feel free to email us back with any suggestions thanks.

I’m in Montana and AutoVest tried suing me. It shockede because it was about 6 to 7 yrs later when I had never heard anything from them. Anyway I got scared and file bankruptcy before the lawsuit defaulted. I would of never claimed bankruptcy if they hadn’t came after me and now that’s on my record for 10 yrs! Is there anything I can do?

Thanks,

Penny

If they already got a judgment and you listed it in your bankruptcy as a valid debt, then there may not be anything you can do. But you’ll need to speak to a Montana lawyer about that. Go to http://www.consumeradvocates.org and you’ll find one there.

I am being sued by Autovest and they as of yesterday decided to garnish my wages and my employer has no choice but to take 25% out of my check in order to pay back the loan. I need your help. I can not afford to live on what is left after they take the money out. The car loan was in 2008 and my Truck was repoed in July of 2009. Do you know of any attorney’s in Florida that would help me?

Kevin,

I know a few lawyers in Florida who may be able to help, but I need to know where you’re located. Or you can go to http://www.consumeradvocates.org and find a lawyer in their membership directory. That is the website of the National Association of Consumer Advocates, and there you will be able to find a lawyer in your local area.

JEC

I reached out to this company and i hope that they will get back to me. My loan was from March of 2008 to March of 2011 but i defaulted on the lease in July of 2009. I was never contacted by anyone until AutoVest did in September of 2015. I did some research and there is a 4 year window they have to collect a debt in the State of Florida. My question is do you there is anything anyone can do to stop this. As of last week they have garnished 25% of my wages until the loan is back back. The loan was through Chrysler Financial who declared or filed for bankruptcy no too long ago. Is there anything anyone can do to stop this? Apraently a judge did sign off on this but why would they come after me when it has been nearly 7 years

Exact same issue as Kevin. I live in Georgia, but the judge signed off on the judgment in Nevada. Can anything be done? I was blindsided by this wage garnishment.

Curtis,

unfortunately, that’s a pretty hard question to answer, and definitely not something I can do based on short email message. If you want to attack the judgment, you’re going to have to go to the court where the judgment was entered. That means you’re gonna need a lawyer in that area.

Best of luck on this.

I need help Autovest LLC is suing me for a car I purchased in 2005 that got repo in 2009 and now they are suing me in 2016 for three times the amount owned.

Charlotte,

Where was the lawsuit filed against you? Without knowing what jurisdiction your’re in or the details of your case, I can’t really help you. However, it is generally a good idea not to go down without a fight. If you never made a payment after the 2009 repo, then in most states, it is too late to sue you on that account.

I strongly recommend that you contact a lawyer in your area to fight this. Best of luck!

I’m was sued 9 years after I defaulted on my wells fargo loan by autovest I’m in Ohio

Anthony,

I have a friend in Ohio who handles these sorts of lawsuits. Give me a call and we can discuss your rights.

251.272.9148.

JEC

Judson, I live in Wyoming and Autovest repossessed my car back in 09 after the crash. I ignored them for the longest time just digging out of the hole in 08. However, they have just won a judgment against me in 2018 and today I found my bank account minus a $1,000 with a garnishment. From your readings this should not be legal after 4 years. If this is the case, how can I get this over turned once the courts already decided? Do I have to have an attorney now and the likelihood of spending money on one and getting back my money plus paying for attorney fees.

GS,

I can’t advise you as to Wyoming law, because every state has different laws regarding things like statutes of limitation on car sale contracts. However, if they sued you beyond the statute of limitations, then you need to call a lawyer immediately. It may be possible to vacate the judgment against you. But you need to act quickly before the garnishment continues.

Best of luck.

Need for you to call me 205-249-5348 WILLIAM SHAFTT PRITCHETT AUTO VEST IS TRYING TO SUE ME

William,

You can call my office any time to make an appointment to discuss your case. 251.272.9148.

I recently had my wages garnished on a 08 repossession of my Land Rover with Wells Fargo. 10 years later and it is already in the court systems obviously if they were granted a right to garnish my US Bank account 1000 on Friday. Can I sue them and can I reclaim my legal fees if I do since this is well past the statue of limitations. I live in Wyoming now but I bought the car in California and their claim was in Wyoming.

I was just served by Autovest, I had never heard of them. It looks as if they bought the contract I let go over 3 years ago because husband was deathly ill and was awaiting disability. The car was purchased for $10k, they are suing me for $7k. I have my husband and my mother, both handicapped, living with me and I am the only one working, I can’t afford a garnishment. What can I do to fight this company?

Angela,

I can’t give you specific legal advice because you’re not my client, but I can tell you that whenever you receive a summons in a collection lawsuit, you always should consult a local attorney who knows how to deal with these cases and make sure that you get a written answer filed with the court before the deadline to respond. In Alabama, you have 30 days to answer a circuit court lawsuit and 14 days to answer a district court lawsuit.

If you’ve been sued in Alabama, feel free to call my office to discuss this. My number is 251-272-9148.

Best of luck.

JEC

I am being sued by atuovest in Chicago Illinois. For car that was a voluntary repossession in 2009. They suing me for $19,000. For 2006 buick Lacrosse. That cost $ 11,000. When purchased it in 2008. The engine went go and dealership. Da’Andan Buick on 72nd &Western. Shut down by GMC. Wellfargo was the bank that carry the note. Both company’s had case actions suits filed against them for bad loans. I’m trying to fight back. Autovest should not profit from bad loans on bad cars.

Maurice,

I hate hearing about experiences like yours. It really is unfair for you to be the one saddled with both the debt and a bad vehicle! But I can’t help you personally, since I’m not licensed to practice law in Illinois. You definitely need to speak to a local attorney who handles debt and credit cases in Chicago. Best of luck, sir!

JEC

I have the same situation they sent me to court for a vehicle that was totaled and insurance had covered it. 4 months ago a Company saying that are acting on behalf of Autovest said I could settle with them Company is called Premier Holdings and they said I could settle with them for a $1000 and I did so. I have all Settlement letters and then after one month a law office called Andreu Palma and Levin calls me for the same debt. I sent them everything telling them that I settled with Premier Holdings and they said that the original creditor has not received that payment long and behold I checked my bank account the offices of Andreu Palma and Levin put a levy on my bank account and wiped my entire savings. And also my salary is going to that account and will be wiped out tomorrow at the tune of $5400. I need to resolve this situation since I cannot then pay my rent or buy food.

Deborah,

You definitely need to speak to a lawyer in your area. This sounds shady and you need legal advice.

I have a different situation. I was divorced in 2016. My husband and I were together on a loan with First Investors. The loan was almost paid off. It was down to 700.00 when I had a heart attack and lost my job and husband. My car was never repossessed. However, Autovest claims to own the debt to it but not the title. They want me to pay them but I don’t get a title in return. I have filed an answer with the court. They have been trying to sue me since 2019 but didn’t get me served until April 2020 and my exhusband was never served papers because they couldn’t locate him. They tried to ask the judge for a default judgement but the judge ordered it go to trial because he is unsure why it has taken them so long to get anything done with this lawsuit. I was served in April of 2020 and responded with telling the courts that I’m not paying Autovest for anything because they don’t have the title to my car. I go to trial next week. Is there anything else I need to know before I walk into it.

AutoVestLLC is attempting to sue me but it’s been over 10 years in Alabama is that past the limitation

AutoVestLLC is attempting to sue me but it’s been over 10 years in Alabama is that past the limitation can they do that

Please call my office. I would need to see a copy of the complaint and other lawsuit documents, but if what you are saying is true, we should definitely be able to help you.

Hello

Autovest has garnished my wages starting September 2022, spoke to several lawyers and only option is bankruptcy. Problem is autovest is not the original debtor, it’s First Financial and its was back in 2013 the car was repo in 2019.