Alabama FDCPA Attorney Judson E. Crump (251)272-9148

Have debt collectors, debt buyers, or collection agencies been crossing the line? Federal laws like the Fair Debt Collection Practices Act and the Telephone Consumer Protection Act prohibit debt collectors from doing anything deceitful, abusive, harassing, or oppressive. You have rights.

Here are a few examples of illegal collection conduct:

Deceit. Has a Collection Agency lied to you? That’s illegal: they can’t ask for more money than you actually owe, they can’t ask you for money you didn’t borrow; and they can’t threaten to do anything they don’t have the right to do, like garnish your wages, take your furniture, or throw you in jail.

Ignoring Privacy. Has a collector been calling you at work? Collectors cannot contact you at unreasonable times, tell other people your private business, and they can’t be sneaky about disclosing their identity.

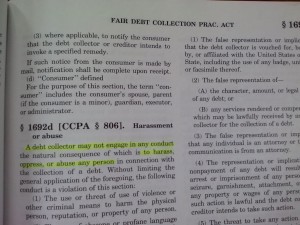

Harassment & Abuse. Have debt collectors dealt with you unfairly or used abusive language against you? That’s illegal. They can’t call you after 8 PM or before 9 AM, they can’t use profanity or personal insults. They can’t report false information on your credit reports.

Calling Without Authorization. A debt collector cannot send automated phone calls to a cell phone unless you’ve given them express permission to do so. This one gets violated quite often. Note that if you gave that phone number to an original creditor, that counts as consent for the collector to call you as well. However, if you’re getting collection calls on a cell phone number that you didn’t even have when you dealt with the original creditor, they’re likely breaking the law.

Telling Other People Your Business. A debt collector cannot speak with anyone but you or your spouse about your financial affairs and debts. Not in writing, on the telephone, on Facebook, or anyhow else. They can contact third parties ONLY to try to locate you, but they cannot tell third parties the nature of their reasons for contacting you. There is an exception to this rule for formal legal pleadings.

If someone collecting a debt from you is breaking the law, you don’t have to take it. We can stop the harassment and even turn the tables on them – putting money in your pocket. Call me today and we’ll fix it. 251.272.9148.

Read More:

Guide to Debt Collection Rights, Part I: Collection Calls

Guide to Debt Collection Rights, Part II: Deceit

Guide to Debt Collection Rights, Part III: Privacy

Guide to Debt Collection Rights, Part IV – Validation