If someone owes you money, you cannot wait forever to take them to court. The law places a time limit on every lawsuit. It’s called the Statute of Limitations.

And the Statutes of Limitation exist for good reasons. Evidence gets lost. Memories fade. People move on with their lives. Business would be severely hampered if everyone had to worry about junk from 20 years ago rising up to cause problems today. So we don’t allow that. If somebody does you wrong or owes you compensation for some reason, you have a specific amount of time to act. Speak now or forever hold your peace.

For most contracts in Alabama, the statute of limitations is 6 years. This applies to written contracts or oral contracts. And for lawsuits alleging breach of an obligation to pay money, the time limit starts to run on the date the last payment. So if you borrow $1,000 from a creditor on July 1, 2009 and you quit paying January 1, 2010, they can probably sue you at any time before February 1, 2016.* But that’s not the end of the story.

*Why the extra month? Because if your payment is due at the beginning of the month, and your last payment was January 1st, then your first missed payment was not until February 1. Technically, the statute begins on the date the contract is breached, but is revived with each later payment.

Certain contracts have different rules, and very often in a collection case, a different statute will apply.

On Contracts for the sale of goods, the statute of limitations is 4 years. Why? Because sales for goods are governed by the Uniform Commercial Code – a set of rules that was established many years ago and adopted by 49 of the 50 states to ensure that commercial transactions were subject to the same rules nationwide. This helps make business flow smoothly across state lines, because imagine if you were a nationwide retailer and you had to comply with 50 separate standards for how your transactions were made and enforced?

So what is the statute of limitations on a credit card?

Well, credit cards, like almost all loans, cannot be issued without written disclosures of the interest rate and APR. And as a practical matter, there isn’t a single credit card in existence that is issued without some sort of writing showing the terms and conditions of the contract. So it would seem that the 6 year statute of limitations for a contract applies, right?

Yes, but only if the credit card company can prove the existence of the contract. See, the court cannot just presume that a contract exists because a credit card was issued. Why? Because not every agreement is a contract. A contract has 5 basic elements:

- An Offer;

- An Acceptance of the Offer;

- Consideration (each side is giving something and receiving something)

- Capacity (each party has the ability to contract – i.e. you’re not a child or in a coma)

- Legality (some contracts are not enforceable, like drug sales or prostitution payments)

And there’s a big reason this is important: because credit cards don’t sue people and just ask for a return of the money that was spent on the card. They ask for way more than that. In most credit card lawsuits, the card holder has been making minimum or short payments for months, if not years by the time the suit is filed. And if you’ve made payments less than the full balance for a couple of years, then you have probably paid the credit card company far more than they ever lent you.

And even if they can show that you did spend some of their money, the law does not give them interest, late fees, penalties, or attorney’s fees unless the contract specifically says so. So even though you may have paid them back twice what they’ve given you, they still claim a balance because they say you owe them a ton of interest accrued at very high rates. And if they can’t prove the terms of the contract giving them interest, penalties, etc., then they don’t get it.

So what if they can’t come up with any contract you’ve signed? Then they can still sue you under a different legal theory called Account Stated. An account stated is an old relic of the days when people had accounts at the stores they regularly shopped at and bought things ‘on account’ and settled up at the end of each month. It doesn’t really apply to credit cards, but if the credit card company can show that they sent you a statement with the amount owed and you accepted that statement (either explicitly or implicitly), then they have an account stated. Account stated suits have a 6 year statute of limitations. So even if they can’t prove a contract, they can still take 6 years after your last payment to sue you. This is a bit easier for most credit card companies, because they don’t have to prove a contract, just that some money was owed, that they sent you a statement of how much was owed, and that you accepted the statement. You can accept a statement by receiving it and not objecting. If you object, then the account stated won’t work. The silver lining of being sued for an account stated is that the balance stated does not gather interest. This can save you a lot if you get sued on account stated for “$1,000 plus interest from the date of default,” which is lawsuit language you’ll often see in collection cases.

So what if they can’t prove a contract or that you were sent a statement that you didn’t object to? In that case, the credit card company or collector is stuck with a much weaker cause of action called Open Account. The statute of limitations on an Open Account is three years. And it doesn’t give them interest, attorney’s fees, late fees, or anything but the amount they can prove was owed on the account. Open account is sort of a catch-all option for situations where money is owed, but the facts of the case don’t quite meet the requirements for a Contract and an Account Stated.

This may all sound quite complex, and if you’re confused, you are not alone. The fact of the matter is that our statutes of limitations were written long before credit cards even existed. So the law as written doesn’t match the realities of modern business. Courts have to try and apply the statutes we have to the facts we have, and credit card accounts are highly complex business arrangements. If you’re being sued by a debt collector or credit card company, this is to your advantage. They bear the burden of their own business practices, and they make a ton of money off of people who are behind on their payments.

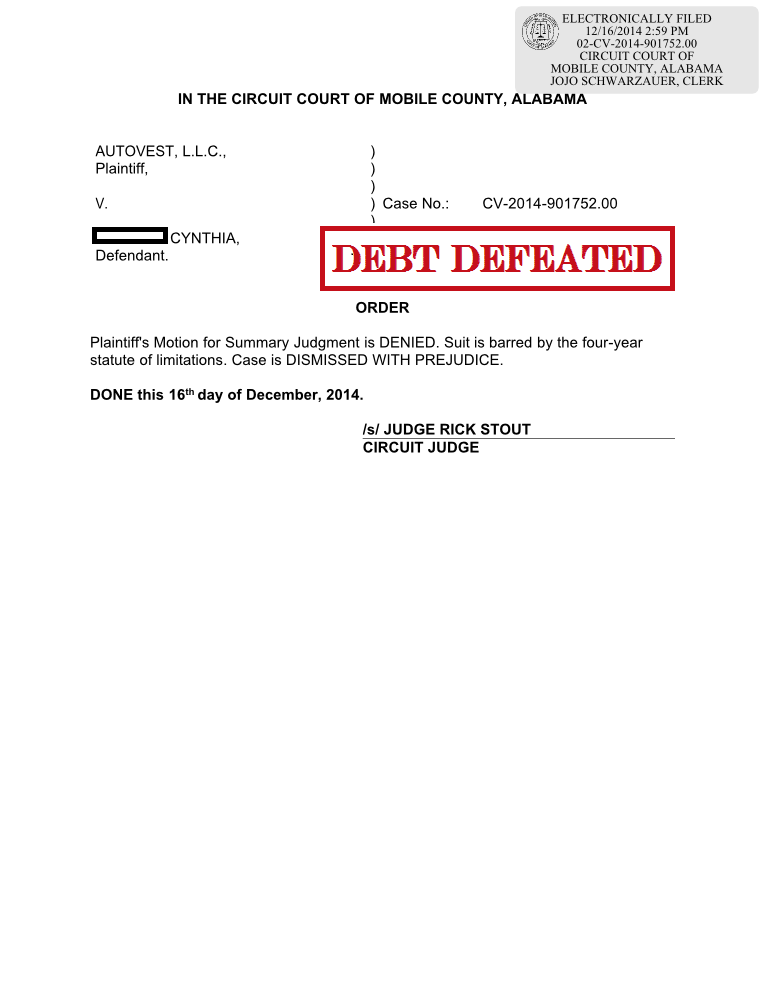

So don’t be afraid to fight them.