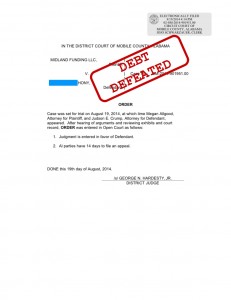

Midland Funding Lawsuit Defeated – Mobile, Alabama Attorney Judson E. Crump

My client was sued by Midland Funding for a credit card account they said he once had with HSBC Bank Nevada, NA. I answered the complaint for him and the case was set for trial. The collection lawyer was there with a stack of documents they said proved their case. I objected to them, and normally I succeed in getting their evidence kicked out. But the judge let them into the record anyway. It didn’t matter.

The judge considered their evidence, but found that it just wasn’t enough, so we won. I’ve represented consumers sued by Midland Funding 4 times this year and beaten them 4 times. Hopefully I can keep up this streak.

No lawyer can ever promise a victory in court or any result, for that matter. But if you live in Alabama and you have received notice of a lawsuit by Midland Funding or Midland Credit Management, then you may want to give me a call. 251.272.9148.

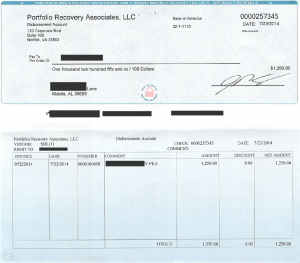

Debt Collector Pays Mobile, Alabama Woman to Settle FDCPA Lawsuit – Alabama Consumer Credit Attorney Judson E. Crump

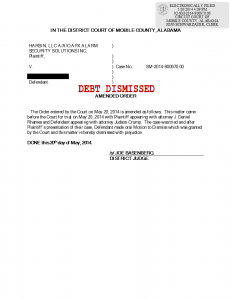

Back in October 2013, a Mobile woman came to me with a debt collection lawsuit brought against her by Portfolio Recovery Associates. She was in dire straits and had no way to pay for a lawyer, but she also could not afford to lose 25% of her wages to a garnishment. So I took her case pro bono. I went to the District Court and after I appeared in the case, the collection attorney dismissed the lawsuit. All was well, or so we thought.

Until my client called me saying that she’d received a phone call from Portfolio Recovery Associates seeking to collect on the debt. That’s illegal, so I sued them in federal court on April 10, 2014.

The federal court did not make any findings that PRA had violated the law, and PRA did not admit to violating the law. But they did agree to settle the case by paying my client $1,250 and paying my attorney’s fees separately, so my client got to walk away with $1,250 for her trouble. She really needed the cash, too, because the same week she got her settlement, she got hit by a hit-and-run driver.

A debt collector cannot call you to collect a debt that’s been dismissed in court.

A debt collector cannot ask for money for a debt you’ve already paid or settled.

A debt collector cannot report a paid-off debt to a credit reporting agency as still being owed.

Like the rest of us, debt collectors must obey the law. If they don’t, they must pay. It’s quite simple.

If you’re getting harassed or troubled for debts you’ve settled, paid, beaten in court, or just don’t owe, you CAN do something about it. And it can be worth your time, too. Just ask my client.

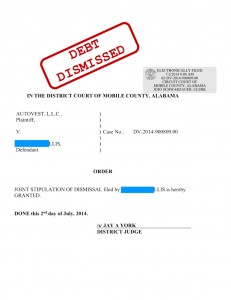

$4,700 Auto Loan Lawsuit Dismissed – Alabama Consumer Credit Attorney Judson E. Crump

Counterclaims under Truth in Lending Act Convinced Autovest to Dismiss their Case

Though there are countless ways to attack a collection lawsuit, most cases come down to a simple lack of evidence on the collector’s part. But this case was a bit different. My clients were sued by a debt buyer called Autovest, LLC. As I’ve written before, Autovest is a Michigan company that buys charged off repossession deficiencies and sues consumers for the debts. Auto loans are subject to a number of defenses and possible counterclaims because

a) repossessions are subject to lots of abuse by careless and rude repo men, giving potential counterclaims under the UCC Article 9 and

b)car dealers are so sloppy and errors in loan origination are very common. This can give you counterclaims under the Truth in Lending Act.

In this case, my clients were sued for an old car loan, and after looking over the dealer sale documents, I noticed some clear discrepancies and omissions on the TILA disclosures. So in addition to filing my answer, I filed a counterclaim under Truth in Lending Act.

Rather than litigate all this, the collector just decided to waive their claims if we agreed to waive our counterclaims.

So we filed a joint stipulation of dismissal, and my clients are debt free.

Total savings: $4,707.

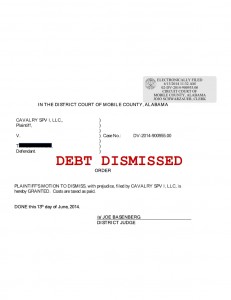

Cavalry SPV I, LLC collection lawsuit dismissed – Alabama Collection Defense Lawyer Judson E Crump

One of my clients was sued by Cavalry SPV I, LLC for a Capital One Best Buy credit card. They claimed that he owed about $5,000 and that they were the assignees of the debt. That means that Capital One/Best Buy gave up on trying to collect from him directly, and sold the account to Cavalry SPV I, LLC. Cavalry is a debt buyer, which means that their entire business revolves around purchasing old charged off accounts from creditors who either cannot or will not (because they don’t want their name associated with the negative PR) take legal action on their own.

I entered the case after my client had answered pro se and received a trial date notice. I contacted the opposing counsel about their evidence and we agreed to have the case dismissed with prejudice. This means that the debt, if it ever existed, is gone forever. My client can send that court order to the credit bureaus and demand that they remove the account from his credit report.

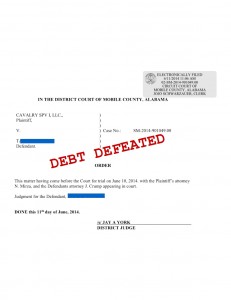

Cavalry SPV I, LLC Collection Lawsuit Defeated- Alabama Collection Defense Attorney Judson E Crump

Our client was sued twice by Cavalry SPV I, LLC for $2598.80 on a credit card he once had with HSBC. The card had, allegedly, been transferred to Capital One Bank, N.A. at some point, and then to Cavalry SPV I, LLC. Cavalry SPV I, LLC then sued my client. He answered the complaint pro se (after having read my book) and then hired me to come to trial for him. I notified the collection attorneys of my appearance in the case and requested copies of their evidence. We were able to convince the judge to exclude their evidence from the record and rule in our favor.

The case was heard in the District Court of Mobile County, Alabama. The debt, if it ever existed, must now be permanently removed from my client’s credit reports. Another victory for Alabama working folks!

Who’s suing you, Part IV: Who is Cavalry SPV I, LLC? – Alabama Consumer Credit Attorney Judson E Crump

Cavalry SPV I, LLC is a fairly standard debt buyer. They purchase old accounts that have been charged off to loss by the original creditor. I have fought Cavalry SPV I, LLC in court before. On August 27, 2013, I tried the case “Cavalry SPV I, LLC v. Andry” in the District Court of Mobile County, Alabama, and won a judgment for the defendant. That lawsuit was brought on an account allegedly owed to CitiFinancial for about $3,000. Now it is gone forever.

I have defeated or dismissed several cases Cavalry SPV I has brought against Alabama citizens since then, so I can assure you: with the right lawyer on your side, you do have a fighting chance!

If you have received a summons from Cavalry SPV I, LLC, be sure to answer the lawsuit. Cavalry SPV I often doesn’t send collection letters or make phone calls before suing you, so some people assume that the summons is bogus or a scam. Whatever else they might be, Cavalry SPV I, LLC is not a scam! If you read my articles, you know that I will tell you if an outfit is a scam or not, and Cavalry SPV I is not. They are a real debt buyer and if you get a summons from them, it is a real lawsuit and if you don’t answer, they will get a default judgment against you and that will enable them to place liens on your property and garnish your wages and bank accounts. Trust me: you don’t want a default judgment against you.

Fortunately, Cavalry SPV I, LLC is not hard to beat in court if you have the right lawyer on your side.

Dealing with Requests for Admissions in a Credit Card Lawsuit – Alabama Consumer Credit Attorney Judson E Crump

Proving a credit card debt can actually be a tricky thing if you have serious opposition. But collection lawyers have a few tricks up their sleeves that you may encounter. One of the worst is a discovery device called “Requests for Admissions.”

What is a request for admissions?

A Request for Admissions is a written demand that you admit or deny specific factual assertions made by the adverse party. So how is it different from just denying the allegations in a complaint? Well, the rules say that you can get in trouble for denying things that the other side later proves to be true. Furthermore, screwing around with a request for admissions can give the court reason to sanction you for doing so. Sounds scary.

But what does it mean in reality? The specifics depend on your state, but usually it means that if you deny something that you’re later shown to have had no basis for denying, you can be made to pay the other side’s attorney fees – in addition to whatever judgment they’re entitled to. Sounds even scarier. But it isn’t. Like most discovery sanctions, it is usually pretty lame in reality. To illustrate why, I’ll use an example.

Bubba is sued by Capital One – the most aggressive credit card company I know of – for $20,000 (plus interest, plus court costs, plus attorneys fees) on a business card that he used for his plumbing business. Bubba denies the allegations in the Complaint, and so Capital One sends some Interrogatories and Requests for Admissions. Now let’s look at two possible scenarios: One where Bubba answers honestly that he owed at least part of the alleged debt, and another where he just flat out denies everything.

In scenario A, Bubba admits part of the debt, Capital One moves for summary judgment based on their affidavits and his admissions, and gets a judgment for $20,000 plus court costs, plus attorney’s fees, plus interest – something like $22,000.

In scenario B, Bubba sends a two page letter telling Capital One that he doesn’t know the answer to most of their questions and denies all of the Requests for Admissions. Capital One gets angry at him and comes to court prepared. Bubba shows up and loses at trial because he doesn’t know what he’s doing. Capital One gets a judgment, but this time they add the costs of the attorney’s fees that they incurred by his failure to admit what they later proved at trial. So now they get a judgment for $20,000 plus court costs, plus attorney’s fees, plus interest PLUS what? Plus the portion of the attorneys’ fees that can be traced back to his failure to admit everything. So instead of a $22,000 judgment, he now faces something like a $22,500 judgment.

The fact is, credit card contracts give the credit card company the right to collect attorneys’ fees and interest at their super high rate anyway. So the amount of heat that the Requests for Admissions penalty isn’t nearly what it would be at, say, a personal injury trial. I’m not telling anyone to make bad faith denials of any discovery request. I just want you to understand that, like many things you may face when dealing with the credit card industry, the truth isn’t quite as scary as some would have you believe.

$3100 Alarm System Collection Suit Dismissed at Trial – Alabama Consumer Credit Attorney Judson E Crump

Last week, a client came to me who had been sued by a debt buyer for $3,100. Allegedly, the debt was based on an old alarm system account that had gone unpaid. The debt buyer, a smaller outfit called Harbin, LLC, actually brought a corporate officer to court to testify as to their documentation and information procedures. We made a number of objections to their proof, and the court sustained several of them. My client was in court and prepared to testify that she had in fact paid the debt, but it wasn’t necessary. At the close of the debt collector’s case, I moved for dismissal based on their inability to prove their case. The court sustained my objections and entered an order dismissing the case. Another collection lawsuit defeated in Mobile County.

Next week: I go to Fairhope to take on Midland Funding in Baldwin County. They subpoena’d my client as a witness, which is an unusual step. We’ll see how it goes.

Another Victory: Beat a $13,000 lawsuit by Midland Funding today. – Alabama Consumer Credit Attorney Judson E Crump

Our continuing efforts to save the families of South Alabama from credit card debt have born another ripe fruit today. In Mobile County Circuit Court Case No. CV-13-901687, I appeared in court today to defend my client from a lawsuit demanding $12,967.43 + $260 Court Costs for an alleged Sears Mastercard account. The Plaintiff, Midland Funding, was represented by Holloway & Moxley of Montgomery, Alabama and they did an unexpectedly good job of proving their case. Midland sent in a witness from St. Cloud, Minnesota to testify as to the accuracy of Midland’s records.

After a 1 1/2 hour trial, we won a judgment for the defendant.

Here’s a copy of the order:

The South Alabama debt relief stimulus package continues…