Autovest, LLC Sued my client for a deficiency balance owed after her car was repossessed. We beat the lawsuit by showing that the suit was illegal due to the passage of the Statute of Limitations.

My client had in fact owed money to Wells Fargo Financial Acceptance for a 2007 Dodge Magnum she had purchased back in April 2007. But as often happens, the car broke down and when the dealer wouldn’t fix it, my client had to find new transportation. She couldn’t afford to pay both, so she stopped paying in May 2009 and the car was repossessed in May 2010. For 4 years, nothing happened.

Then, in June 2014, my client received a summons from some company called Autovest, LLC, relating to a lawsuit in the Circuit Court of Mobile County, Alabama. She had never heard of Autovest, and had no idea who they were. She certainly had never entered into any contract with Autovest. So who are they?

Autovest is a debt buyer located at 26261 Evergreen Rd, Suite 390 Southfield, MI 48076. They purchase charged off accounts from creditors who no longer wish to collect them. In this case, they claimed that Wells Fargo Financial Acceptance had assigned my client’s auto sale contract to Autovest, and that by virtue of the assignment, they had the right to sue my client.

She came to my office and naturally she was very upset. After all, they were asking the court to force her to pay them almost $10,000 and she had no idea what to do about it. But when showed me the paperwork, I saw an immediate problem: they were too late.

See, if someone owes you money, you cannot wait forever to take them to court. The law places a time limit on every lawsuit. It’s called the Statute of Limitations. For most contracts in Alabama, the statute of limitations is 6 years. But on a contract for the sale of goods, we have a different rule: the statute of limitations is 4 years. Why? Because sales for goods are subject to a special rule in the Uniform Commercial Code: Article 2, Section 725.

A vehicle sale contract – even one where the car purchase was financed over a 60 month installment contract, is still a contract for the sale of goods. And in this case, the collector waited until more than 4 years after my client’s last payment to sue her. In fact, they waited longer than 4 years after the car was repossessed. This was undisputed.

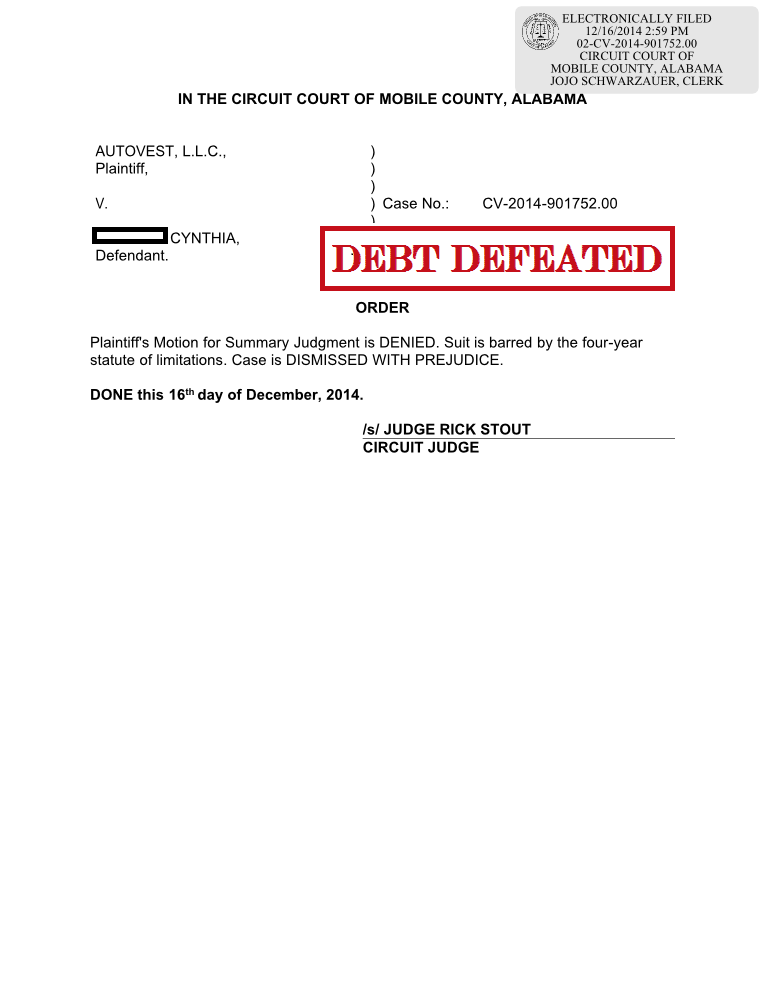

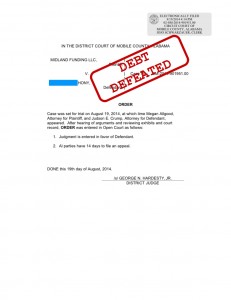

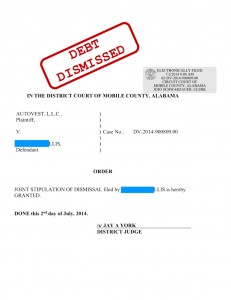

Well, you can’t do that. The law is clear. If you want to sue on an retail installment sales agreement, you better do it in 4 years. The court agreed with me.

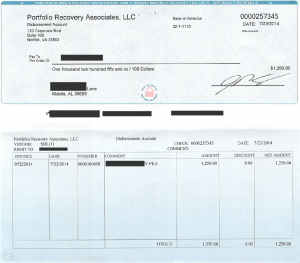

See: