Another Midland Funding Lawsuit Dismissed – Alabama Collection Defense Attorney Judson E Crump

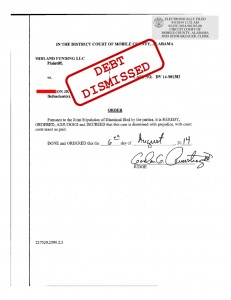

Another collection lawsuit by Midland Funding, another victory for an Alabama consumer. Back in May, my client received a lawsuit summons from Midland Funding, they claimed that he owed them $3,573 for a credit card account with GE Capital Retail Bank.

My client answered the complaint pro se and hired me to represent him at trial. I notified the court and the collection attorneys of my appearance a month or so before trial. At trial, they did not have a witness or the requisite certifications to prove their case, so they agreed to dismiss it on the spot.

Some folks think that you have to have a lawyer to answer the lawsuit. You don’t. And if you answered a lawsuit on your own, only to find later that you may be in over your head, it is not too late to hire a lawyer. I have been hired the day of trial before, though I ask that my clients retain me at least a full week before trial in order to give me time to prepare and to notify the other side of my involvement – something that professional courtesy requires, in my opinion.

Beat Midland Funding (Again) – $2,000 collection lawsuit in Baldwin County – Alabama Consumer Credit Attorney Judson E Crump

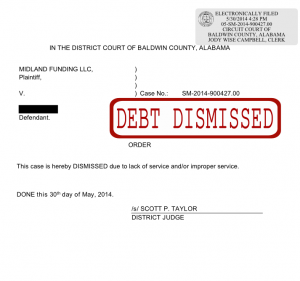

On Friday, May 30th, I tried another collection lawsuit against Midland Funding – this time in Baldwin County, at the Fairhope Courthouse. For those who aren’t familiar with Alabama’s largest county, Baldwin County actually has three separate courthouses. The main one in Bay Minette is at the northern end of the County, and for people who live down at the beach, the county seat is over 60 miles away. That’s a 1.5 hour trip for people living in Fort Morgan. So a few years back, the county opened a satellite courthouse in Foley for the beach folks, and a satellite courthouse in Fairhope for those who live in the more heavily populated Eastern Shore of Mobile Bay.

This case was about an old computer purchase. They claimed that my client bought a Dell computer from a company called WebBank, who was at the time in charge of financing options for Dell computer sales. Dell Financial Services was the “servicer” of the loans. And WebBank at some point sold the account to Asset Acceptance, who sold it to Midland Funding, who then sued my client for $1900 plus court costs.

Midland actually took the case seriously: about a month before trial, they subpoena’d my client to appear in court. This is something they don’t do unless there’s an attorney involved. If you answer pro se, they’ll expect you to appear on your own. Some lawyers instruct their clients to answer pro se and then the lawyer appears on the day of court to ‘ambush’ the collector, and that’s fine, as long as no “ghostwriter” pleadings are involved, but I’ve found that isn’t even necessary. Now, sometimes a client really does call me the day before a trial and I’ll appear for them, but I prefer to let the collector know that I’m coming from a long way away. It usually doesn’t affect the end result.

When they send you a subpoena, it just means that you have to show up and testify. The idea is to try to get you to prove a) that you owe money and b) that their statements and assignment documents are true and admissible as evidence. So in this case, my client had to show up for trial and Midland’s lawyer called her up to testify. It didn’t matter though, because I convinced the judge to exclude their other evidence and without it, there wasn’t enough to prove their case. So we won.

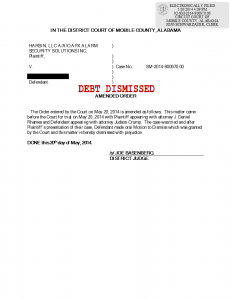

$3100 Alarm System Collection Suit Dismissed at Trial – Alabama Consumer Credit Attorney Judson E Crump

Last week, a client came to me who had been sued by a debt buyer for $3,100. Allegedly, the debt was based on an old alarm system account that had gone unpaid. The debt buyer, a smaller outfit called Harbin, LLC, actually brought a corporate officer to court to testify as to their documentation and information procedures. We made a number of objections to their proof, and the court sustained several of them. My client was in court and prepared to testify that she had in fact paid the debt, but it wasn’t necessary. At the close of the debt collector’s case, I moved for dismissal based on their inability to prove their case. The court sustained my objections and entered an order dismissing the case. Another collection lawsuit defeated in Mobile County.

Next week: I go to Fairhope to take on Midland Funding in Baldwin County. They subpoena’d my client as a witness, which is an unusual step. We’ll see how it goes.

Credit Card Lawsuit Settled for 18% of Balance – Alabama Consumer Credit Attorney Judson E Crump

A client of mine was sued in the Mobile County Small Claims Court by a Asset Acceptance, LLC. The lawsuit asked for a judgment of $2,399.63 including court costs and interest. The debt was based on an account with Dell Financial Services, and was filed under an “Account stated” theory. An account stated lawsuit is basically where you think someone owes you money, but you may not be able to prove a contract existed between the parties. To win on an account stated, you have to show that money was borrowed, that the lender drew up a statement of account showing just what was owed, and the borrower agreed to or somehow accepted that statement of account.

In some places, an account stated has a shorter statute of limitations than a contract, but in Alabama, both are six years. The suit was brought within 4 years of the last alleged payment.

Because it was small claims court, I made a settlement offer to the Plaintiff: $400 plus court costs. That is a deep discount – more than 75% off the original debt, and the credit card lawyer complained about it like they always do, but they know the risk of going to court and losing, so they accepted the deal.

Potential Liability: $2399.63

Settlement: $438.89

Total Savings: $1960.74

Discount: 81.7%

And the South Alabama stimulus package rolls on…