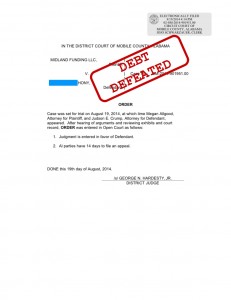

Midland Funding, LLC sued my client over an alleged balance due on a Target Credit Card. We went to trial and won.

Like a lot of Americans, my client had suffered some financial setbacks that caused her to fall behind on some of her bills. When she was unable to work out settlements she could afford, she started getting phone calls and collection notices from strange companies she’d never heard of. One of them was Midland Funding, LLC.

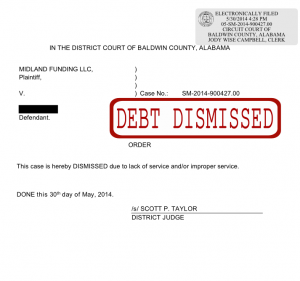

Midland is a debt buyer, or as the credit reporting bureaus call them, a “factoring company.” They claim to purchase large portfolios of charged off debts and then seek to collect them. If you don’t pay them what they demand, they might sue you.

Luckily, the law requires that collection companies prove that they have the right to demand money from you before they can get a judgment against you. You can’t just walk up to a stranger and say “Hey! You owe $3,000 to Capital One, and I’m their collection agent. So you better pay up.”

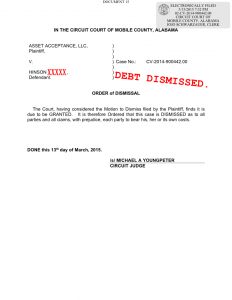

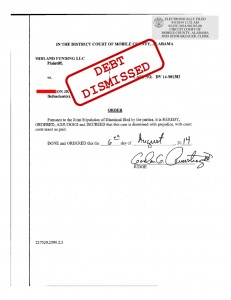

In my client’s case, they were asking her to pay them for a debt she allegedly owed to Target National Bank. We took them to trial and challenged their proof. We won. You can read the Court Order here: Victory Judgment Midland v Delayo.