You should review your credit card statement every month. If you see charges that you do not recognize, here is what to do.

Identity theft is becoming more common than ever. It seems that every few weeks, another massive security breach is revealed on the news. And identity theft can start in a lot of ways. From a digital security breach by Russian hackers to an old-fashioned thief digging up an old credit card statement from your garbage to an angry ex-wife spending money using stolen credit cards. Regardless of how it happens, a telltale sign is the existence of bogus charges on your credit card or debit card.

Maybe you’ve seen TV commercials where credit card companies advertise their “Zero liability for unauthorized purchases” policies. This always makes me laugh, because it is a super clever attempt by the credit card companies to seem generous. And here’s why it is bullshit: they have to do that.

If you see a charge on your billing statement that you didn’t make, then you can simply write a letter to the credit card company disputing the charge. And once you provide them with written notice that you didn’t make the charge, you cannot be held liable for more than $50. By federal law. So even if an ID thief spends $2,500 on your card, the bank can’t charge you more than $50.

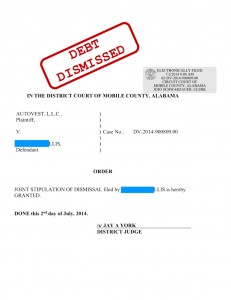

Furthermore, if you decide not to pay the disputed amount, the bank can’t sue you for it. Because the Truth in Lending Act requires that in any action to enforce a credit card liability, the issuer of the card is the one who must prove that the charges sued for were actually made by the person being sued. 15 U.S.C. Sec. 1643(b).

So if you do see an amount that you don’t recognize on your bill, here is what you do.

First, you flip your credit card statement over and look for the “correspondence address” or “billing dispute address.” If the issuing bank has an address for disputes that is different from the payment address (and they usually do), then you MUST send any dispute to the designated address.

Second, you send a letter to that address describing briefly your dispute. You don’t need to give them the history of your credit card or the reason why the charge is bogus. You just need to tell them that you didn’t make the charge and that you aren’t going to pay for it. Your letter must include the account number, your name and address, and a precise description of the charge you dispute.

They must respond within 30 days. They’re supposed to conduct an investigation and figure out if you really didn’t make the charges. If they conclude that you didn’t make the charges, they have to let you off the hook for the charges. If they conclude that you did make the charges, then they must send you documentation that they’re right and you’re wrong.

If they don’t comply with these rules, then they cannot charge you for the disputed amount or any finance charges thereon.