Alabama Consumer Credit Lawyer Judson E. Crump discusses how dumb mortgage servicers can be.

Video Nov. 2014 Q&A: Who are the worst businesses you deal with? Sketchy Car Dealers! – Alabama Auto Fraud Attorney Judson Crump

Alabama Consumer Protection lawyer Judson E Crump discusses why he believes Used Car Dealers are the sketchiest businesses around.

The Lone Justice Ruling for the People: Scalia? – Alabama Consumer Credit Attorney Judson E. Crump

Koons Buick Pontiac GMC v. Nigh – 543 U.S. 50 (2004). Proof that Judges aren’t just partisans.

The U.S. Supreme Court now has 5 “Republicans” and 4 “Democrats.” Since I get my knowledge of the world from the TV Channels or internet news sites that disagree with me the least, I know this to mean that if an abortion case goes before the Court, 5 justices will rule against abortion and 4 will vote for it. And that in a suit between a large, moneyed corporation and an individual seeking to exercise his federal rights, there will be 5 votes for the corporation and 4 votes for the human.

No, that isn’t how it works. A great example is the 2004 case of Koons Buick Pontiac GMC v. Nigh.

Bradley Nigh bought a car from Koons Buick. Unfortunately for everyone involved, the dealer inflated the sales price of the vehicle with a bogus charge for a “Silencer,” whatever that is. Nigh found a lawyer who had heard of the Truth in Lending Act, and sued the dealer in Virginia federal Court. The jury returned a verdict that the dealer had violated the Truth in Lending Act, and therefore the plaintiff was entitled to a statutory damage award of twice the finance charge, which ended up being about $25,000. It was a high interest loan.

First, a note on statutory damages. These are a lot like punitive damages, in that they’re authorized to penalize a violation of the law. But unlike punitive damages, they are typically limited to a small amount of money. The Fair Debt Collection Practices Act, for instance, has statutory penalty of $1,000. This means that if a debt collector or collection firm violates that statute, then even if the plaintiff can only show $10 of actual loss, they can get an award of $1010, because of the statutory penalty. This provides an incentive to follow the law, since we can’t put corporations in jail.

The Truth in Lending Act (or, TILA, as we call it), has a “sliding scale” statutory penalty, which is twice the finance charge, but with a cap depending on the nature of the transaction. Prior to the 1990s, TILA had a $1,000 cap on statutory damages in car loan cases. But in 1995, Congress amended TILA to add a higher $2,000 cap for real estate loans. However, the way they rewrote the statute that year deleted the reference to a $1,000 cap on auto loans, and only left that cap on the subsection referring to auto leases.

Go and read TILA right now. 15 U.S.C. 1640. It’s as plain as day. The statute contains no specific limit on statutory damages for car loans.

But Koons’ lawyers thought that despite the clear language, they should get off the hook because it was Congress’ mistake to delete the $1,000 limit. Yes, the statute no longer stated that the $1,000 limit applied, but since there was no evidence that Congress meant to change that part of the law, the Court should implement Congress’ intent, and not the language of the statute.

Naturally, Nigh’s lawyer disagreed. What Congress writes is the law. If they make an error, they can fix it by enacting an amendment to the legislation. Who are the courts to overturn clear and unambiguous statements whenever the Court thinks it “doesn’t look right?”

To me this case was a shockingly easy one. The statute says what the statute says. That should be the end of it. But 8 of the Supremes disagreed, saying that the car dealers get a freebie on this one because they thought Congress made an accidental error.

Who was the lone dissenter? Antonin Scalia. Not a guy known for his sympathy for the poor and the ripped off. But there he is, dissenting to uphold a $24,000 statutory damages verdict for the plaintiff, while the 4 “liberals” were playing at judicial corporate welfare.

Where Do We Learn This Stuff?

From November 6 through 8th, I’ll be heading down to Tampa, FL for the National Association of Consumer Advocates‘ annual Consumer Rights Litigation Conference. It’s going to be awesome. I mean, look at some of the lecture topics:

“Civil Rights Litigation – Getting and Crunching the Data” – for those Fair Housing Act cases.

“ABCs of the Fair Credit Reporting Act” – I like to think that I already know all alphanumerically abbreviated important points of FCRA, but a refresher never hurts.

“Fighting Repossessions in the 21st Century: New Technology and Legal Strategies” – Repo man stories never get old.

“Dealers Add-Ons, Subtracting Payments from Consumers, Multiplying Profits for Dealers, and Dividing Policy Makers” – Self-Explanatory.

“How to Handle the Math in Mortgage Servicing Cases” – Because apparently I’m not the only one who absolutely hates poring through pages and pages of mortgage payment history printed in a manner where the columns never match up.

“Coffee Break”

“Federal Preemption of State Laws after Dodd-Frank”

“Helping Online Payday Borrowers” – ‘For The LORD will Plead their cause, and plunder those who plunder them’ Prov. 22:23

“The Ethical and Legal Restrictions on Confidentiality Agreements and Sealed Documents”

“The Predatory World of Student Loan Collections: How it Works and What Can Be Done”

“Payment Processors and Originating Banks”

“Jake Halpern Book Signing – Bad Paper: Chasing Debt from Wall Street to the Underworld”

“Medical Debt (and Affordable Care Act Issues)”

“Installment Lending: A Growth Industry Begging for Regulation and Lawsuits”

“Plenary – FILM SCREENING – Lost in the Fine Print (2014, Alliance for Justice)”

“Manufactured Housing: Defending Foreclosures and Attacking Defects in the Homes”

“Challenging Financial Fraud and Scams Aimed at Older Adults”

There’s more. But I’m not going to blog about them since it’s time to get going home to put a roof on my kids new playground I built in the back yard. It is VERY exciting. I love my job.

$8,000 Discover Bank Collection Suit Defeated – Alabama Collection Defense Attorney Judson E. Crump

05-DV-2014-900924 Discover Bank v. Donovan

Unlike many of the Visa and Mastercard issuers (except the customer-hating Capital One), Discover Bank rarely sends its delinquent accounts to collection agencies. Instead, they like to just sue first and ask questions later. Which is exactly what happened to my client. But unfortunately for all of us, Discover didn’t bother to submit any detailed documentation of their allegations. Did a contract exist? How were the alleged balances and finance charges calculated? There simply was not enough information for me to even figure out what was alleged.

This case involved a Fairhope, Alabama client who had been sued for over $8,000 on an alleged credit card account with Discover Bank. I went to trial for him and won a judgment in his favor.

VIDEO: What to Do if You’ve Been Sued in Alabama

Another Midland Funding Lawsuit Dismissed – Alabama Collection Defense Attorney Judson E Crump

Another collection lawsuit by Midland Funding, another victory for an Alabama consumer. Back in May, my client received a lawsuit summons from Midland Funding, they claimed that he owed them $3,573 for a credit card account with GE Capital Retail Bank.

My client answered the complaint pro se and hired me to represent him at trial. I notified the court and the collection attorneys of my appearance a month or so before trial. At trial, they did not have a witness or the requisite certifications to prove their case, so they agreed to dismiss it on the spot.

Some folks think that you have to have a lawyer to answer the lawsuit. You don’t. And if you answered a lawsuit on your own, only to find later that you may be in over your head, it is not too late to hire a lawyer. I have been hired the day of trial before, though I ask that my clients retain me at least a full week before trial in order to give me time to prepare and to notify the other side of my involvement – something that professional courtesy requires, in my opinion.

A Microcosm of the Congressional Dysfunction Created by Industry Lobbyists – Two Letters to the CFPB

Last year, the Consumer Financial Protection Bureau decided to finally get around to regulating sketchy car dealers and other non-bank arrangers of consumer financing.

Why? Because as everyone who deals with auto dealers and their financing partners knows, car dealers very often conceal important facts from the people they deal with. In this particular case, the CFPB was concerned with the way that dealers will hike up interest rates or other finance charges for borrowers who seem unsophisticated or ignorant, and lie about it. Here’s a great and common example: you go to a dealership and find a car you like. You’ve run your credit before, so you believe that you can be approved for about $18,000 of financing at 12% APR. After hours at the dealership going through paperwork and waiting while they make phone calls and work on computers, they present you with paperwork. But to your surprise, the price is $19,000 and the APR is 18%. You say “That seems a bit high!”

“That was all the bank would approve. We checked with 6 different finance companies, and that was the best deal we could find you.”

Of course, this is a lie. The truth is that they are trying to direct you to the finance company that provides the best deal for them – the one that will pay them the most for the contract. And since they pay more for contracts with higher rates relative to the creditworthiness of the buyer, they’re steering you to possibly the worst deal of the 6 companies, and they could have found you a 13% APR.

There is nothing illegal about making a profit. There is nothing wrong with not telling a buyer how much they paid for the car they’re selling you. That’s part of the deal. But there is something wrong with lying to people. When they say: “This is the best deal we could find” that should be the truth. If they want to profit, they should do it like the rest of us by buying things at a low value and selling them at a high value. So the CFPB wants to require them to be more honest.

Naturally, they don’t want to be more honest because that means they’ll be forced to – GASP! – give people fair deals! So they called their lobbyists in Washington and had them pester our Congressional representatives to try and stop the CFPB from helping out working folks. What happened?

13 House Democrats signed a letter demanding that the CFPB provide copies of all data used in determining that sketchy car dealers were lying to people about getting kickbacks from finance companies. Here is their letter:

Page 2. There are 13 signatures in all.

By contrast, here are the letters from the Republicans.

Obviously, the Republican response was more pro-business and anti-consumer. No surprise there. And the way the Republican letter linguistically distorted the facts by using words like “control” and “restricting consumer choice” indicates that the letterw as probably written directly by the auto dealer lobbyists, not the Representatives themselves. That shows you just how much these 35 particular Congressmen are deeply in the pockets of the industry.

But the Democrat response is just as bad. Why? Because it shouldn’t have been written in the first place. There’s a reason only 6.5% of House Democrats signed on. Republicans make no secret of favoring businesses over people. It’s their raison d’etre.

Whose side are they on?

Payday lenders keep calling me after filing bankruptcy. What do I do? – Alabama Bankruptcy Attorney Judson E Crump

We’ve all seen the TV commercials:

“Stop foreclosures, wage garnishments, and repossessions NOW! Call Alabama Bankruptcy Attorney Passem Tuaparalegal TODAY!”

And if you’ve filed bankruptcy, the primary reason you did so was to stop all of your creditors from calling you, taking your paycheck, taking your house, and doing all the annoying stuff that creditors do when they want your money. What you paid for was this thing called the Automatic Stay.

The Automatic Stay.

Section 362(a) of the Bankruptcy Code says that the filing of a bankruptcy petition “acts as a stay, applicable to all entities of —

(6)any act to collect, assess, or recover a claim against the debtor that arose before the commencement of the case under this title;”

It means exactly what it says. Your bankruptcy petition stops all collection attempts. ALL COLLECTION ATTEMPTS.

But as we well know, just because a law exists does not mean that everyone follows it. Sometimes, creditors keep calling and pestering you anyway. Why? They don’t think you’re going to do anything about it. They think that they’re immune to the bankruptcy because you didn’t tell them about it before you filed. They may think that they can keep going after you as long as you have some property that you pledged them as collateral for the loan. Sometimes they just don’t care.

So what do you do?

You sue the bastards.

Section 362(k) – probably my favorite part of the Bankruptcy Code – says that if a creditor willfully violates the automatic stay, you can sue them for whatever damages it causes, plus punitive damages and attorneys’ fees. That’s great news. Willfully, according to the U.S. Supreme Court in Safeco v. Burr (2006), includes any action taken “in reckless disregard” for the law. What does that mean? If they know about your bankruptcy and continue to try and collect anyway, it’s willful.

Here’s an example. A payday lender keeps pestering you. Calling you at home, calling you at work, threatening to call your references, threatening to show up at your job and embarrass you in front of your co-workers and friends and family. So you file bankruptcy. The next time the jerk calls, you say “I’ve filed bankruptcy and my attorney is Judson Crump. His number is 251.272.9148. Don’t call me again.”

And the payday lender employee just laughs in your face and keeps asking you for money. You hang up. They call again. They have violated the automatic stay. Willfully. You can drag them into court to answer for that. If the court finds that they’ve broken the law, they have to pay you and your attorney for whatever damage it causes: including emotional distress damages.

Some bankruptcy specialists really only specialize in the routine aspects of filing and managing bankruptcy cases, and don’t have the staff or the time for litigation against creditors. When my clients inform me that a creditor with definite knowledge of the bankruptcy has continued to call or otherwise seek to collect, I file suit immediately. There is no need for a warning shot or a cease and desist letter. Those are for creditors that accidentally sent a letter or billing statement before they knew about the bankruptcy.

If you call your lawyer to report a creditor that keeps calling you after learning of the bankruptcy, and doesn’t want to take any action against the creditor or collector, you can hire another lawyer to represent you just for the stay violation case. I’ve handled several stay violation cases and enjoy them. If you are looking for an attorney in Alabama to take action against an auto dealer, payday lender, collection agency, or other creditor who is violating your rights in bankruptcy, call me at 251.272.9148 today.

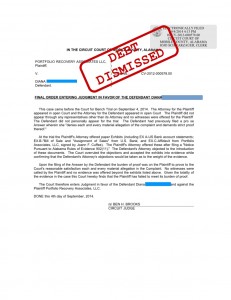

Portfolio Recovery Associates Credit Card Lawsuit Defeated – Alabama Collection Defense Lawyer Judson E. Crump

This case represents a trend I’ve noticed among the circuit judges here in Alabama: allowing sketchy debt buyer evidence into the record, but finding in the defendant’s favor anyway.

My client was a good and honest woman who was working hard to claw her way out of debt. She had recently received a promotion at work that boosted her income just above the threshold for garnishment. So when she got served with lawsuit papers from Portfolio Recovery Associates, she was very afraid. Losing 25% of her paycheck to a garnishment would destroy her financially. They were suing her for $6,100, alleging that she owed that balance from a credit card she had once had with U.S. Bank.

She attempted to conduct some basic discovery on her own, and though it did help her delay the trial of the matter, it did not ultimately help her case. The collector didn’t back down and insisted on taking her to trial. Luckily, she hired me in time to analyze her case for all possible defenses. At trial, I objected to their evidence on several grounds, and while the judge considered it a close decision, he ultimately let the evidence be admitted, but took my objections into consideration as to the weight of the evidence. What does that mean? Basically, it means “We agree that the evidence is sketchy, but not so sketchy that we’re going to completely exclude it. Instead, we’ll take a look at it and consider the sketchiness of the evidence as we make a decision.”

This was a bench trial, and experienced judges can do that. I suspect that in a jury trial, where ordinary people cannot realistically be expected to ignore admissibility issues when judging the reliability of a piece of paper they’ve been given, the judge would have sustained my objection.

In the end, the judge found that the evidence just wasn’t strong enough to issue a judgment against my client. While it is a bit more difficult to win like this, it ultimately is better for the consumer because the decision is virtually immune to appeal. Decisions on admissibility are thumbs-up or down decisions that an appellate court can overturn for any good reason. Decisions as to the credibility of witnesses and the finding of facts are the purpose of the trial court, and could only be reversed if the court of appeals found that the trial court’s decision was so wrong that no reasonable person could possibly reach that decision.

Here, the judge made the right decision, and another Alabama consumer was saved from financial ruin by a debt collector.

- « Previous Page

- 1

- …

- 11

- 12

- 13

- 14

- 15

- …

- 21

- Next Page »