About a million cars are repossessed each year in the United States. Many of these are illegal, though most debtors (and a lot of repo agencies) don’t know it. So just what makes a repossession illegal in Alabama?

Breach of the Peace.

A secured creditor can only repossess their collateral if they can do so without any “breach of the peace.” The Uniform Commercial Code doesn’t define “breach of the Peace,” but the Alabama Supreme Court has. And they’ve adopted a pretty common sense rule: if the repo man violates a criminal statute, then they’re breaching the peace.

Despite this clear and wise rule, repossessions that breach the peace happen all the time. These really bother me because I believe that they show a fundamental disrespect for the human dignity of debtors. How? Because it should be obvious that you can’t commit crimes in order to repossess a vehicle.

“But it’s my job!” says the Repo Man.

“We have a right to get paid!” says Title Max or the car dealer.

OK let’s consider that. My job is to win lawsuits. What if I went into the law offices of my opponents and burned up their files. “I’m just doing my job.” Right? Of course not. A crime is a crime. No matter how poor or black or redneck or worthless you think your debtors are.

So they cannot break any criminal law. What does this mean for you? Here’s some examples:

- They cannot enter the property of someone who doesn’t owe money if that person tells them to go away or tries to block their entry (that’s criminal trespass). They can enter your property.

- They cannot break a lock, cut a chain, or enter your house. That would be burglary.

- They cannot intentionally damage your (or anyone’s) property. If you have a marble statue of St. Theresa of Avila in your front yard, and they drive right over it, they are breaching the peace. This is called criminal mischief.

- They cannot touch you or be violent in any way (that’s Assault).

- They cannot threaten violence (that’s Menacing).

- They can’t harm your pets (animal cruelty).

- They cannot curse you, insult your virtue, or use profanity (harassing communications).

- They cannot use false pretenses to get the keys to your car. Or to get access to someone else’s property.

In other words, missing a payment on a car note does not mean that repo men can commit crimes against you with no penalty. Despite what many creditors, banks, and “pro-business” politicians may think, a person does not become less than human just by falling into financial trouble. As I said, crimes are crimes.

Conversion.

They have to give your stuff back. That’s all there is to it. If they don’t pack it up and send it to you or let you come and get it, then they’re stealing your stuff. If they want to charge you $40 to come and get your own property that they have taken, that is conversion. They can’t do that. If they take valuable things or cash, then you can sue them for that.

Many retail installment contracts and security agreements give them the right to charge a reasonable “storage fee” for holding onto your stuff until you come get it, but even where such fees are authorized by a contract, there is no “storage fee” due unless some actual “storage” took place. If you go to their lot the day of the repo and your belongings are sitting right there in the car that was repossessed, then they haven’t stored anything for you. So no “storage” fees.

They get this one wrong All—The—Time. But it’s still wrong.

Trespass & Property Damage.

There are two types of trespass: trespass on real property (land and homes), and trespass against personal property (cars, boats, books, TVs, everything but land and homes).

Secured creditors do have a privilege to trespass on your own property and to travel on common property (like roads and public parking lots). However, they are not generally allowed to trespass into residential property of people who don’t owe them anything. For instance, if my car is in my back yard, the repo man cannot drive through the neighbor’s yard and drag it out over his grass.

Trespass against personal property generally means physical damage. If they unnecessarily damage or destroy your personal property, then they can be held liable for it.

But beware of one thing: it is also a crime to conceal collateral with the intention of hindering your creditors.

So What If They Break the Law?

A lot of people call me with tales of repossession misbehavior, and they think that if you can prove that the repo man broke the rules, they get their car back without paying for it.

That’s just not true.

Unless the repossession occurred a) when you were not in default, or b) after you’ve filed bankruptcy, you can’t get the car back without paying.

The penalty for an unlawful repossession is cash damages. Generally, they have to pay for whatever damage their misconduct caused, and in some cases they have to pay extra for violating certain laws.

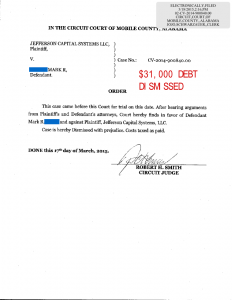

A secured creditor gets to set off these damages against what you rightfully owe. So unless you’ve almost paid off your loan or their conduct was just really bad, then a wrongful repossession suit probably will not put any cash in your pocket, though it can shield you from a lot of future debt.

Example 1: You owe $10,000 on your car. It gets repossessed, and the repo man recklessly drove across your yard and crashed into your boat, causing $5,000 of damage.

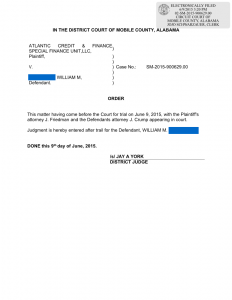

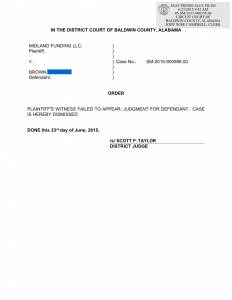

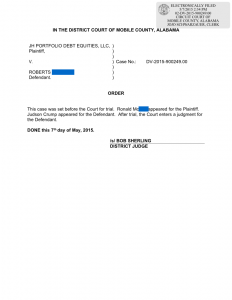

They sell the car at auction for $3,000, leaving you with a deficiency balance of $7,000. If you sue them for trespass, they can counterclaim for the contract deficiency, which is $2,000 more than your trespass damage. So the court enters a judgment for them in the amount of $2,000. You reduced your debt, but that doesn’t help you very much.

Example 2. Granny owes $5,000 on a $30,000 mobile home. She bought it at high interest with $2,000 down 15 years ago. A repo man comes out with a 5th wheel and tries to haul it off, and in so doing, he pushes Granny onto the ground and knocks open a sewage pipe, causing rotten S— to fly all over poor Granny. This is a breach of the peace situation that allows for statutory damages of $12,000, plus some emotional distress damages for being such a jerk to a sweet old lady. Granny will get a cash judgment.