Back in 2015, one of our clients bought a Chrysler 300 from a local used car dealership. It was a buy-here-pay-here deal, so she made her payments each month directly to the dealership. In January of 2018, she fell behind on her payments to the dealer, so the car was repossessed. Luckily, our client was able to gather the money to redeem the vehicle by paying off the remaining balance of $3,200. Redemption of a repossessed vehicle is authorized by Ala. Code 7-9A-623, and whenever a vehicle is repossessed, the secured creditor is required to send you a written notice of intent to dispose of the property before they do so. This gives you the opportunity to buy the vehicle back without losing your equity in it. Once you’ve redeemed the vehicle, it is paid for, and the dealer should transfer the title to you.

Unfortunately, after she redeemed the vehicle, the dealer decided that they didn’t want to convey the title to the vehicle. Instead, they asked for an additional $2,500. These, they claimed, were “repo fees.” But she’d already paid the exact amount they quoted her as the redemption amount. So naturally she refused to pay them any additional money. The dealership, not content to just let it go, decided to repossess her car again, even though she’d paid it off.

Not only did they take the car, but they also took her personal belongings which were in the vehicle. They refused to return these, too.

So in April 2018, we sued them for willful and malicious conversion and trespass to chattels. The case wound its way through the court system, and on November 13, 2018, the Court found in our favor and entered a judgment against the dealership for $24,410.

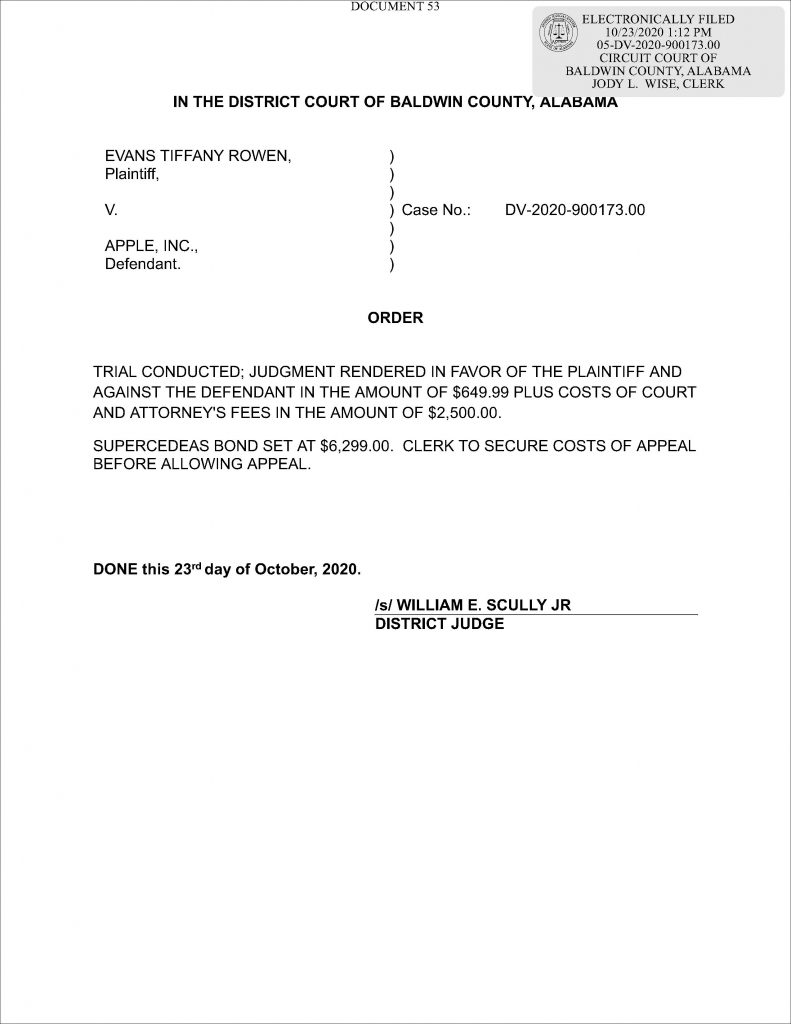

Here’s what a certificate of judgment against a car dealer looks like: