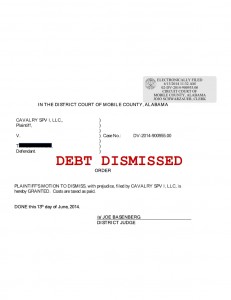

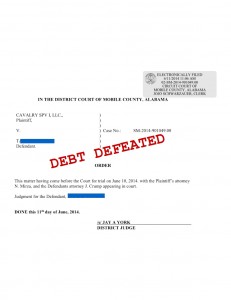

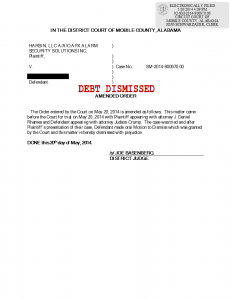

Back in October 2013, a Mobile woman came to me with a debt collection lawsuit brought against her by Portfolio Recovery Associates. She was in dire straits and had no way to pay for a lawyer, but she also could not afford to lose 25% of her wages to a garnishment. So I took her case pro bono. I went to the District Court and after I appeared in the case, the collection attorney dismissed the lawsuit. All was well, or so we thought.

Until my client called me saying that she’d received a phone call from Portfolio Recovery Associates seeking to collect on the debt. That’s illegal, so I sued them in federal court on April 10, 2014.

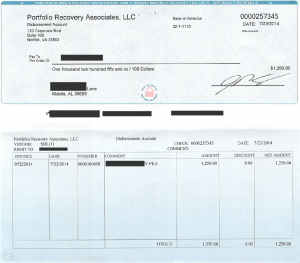

The federal court did not make any findings that PRA had violated the law, and PRA did not admit to violating the law. But they did agree to settle the case by paying my client $1,250 and paying my attorney’s fees separately, so my client got to walk away with $1,250 for her trouble. She really needed the cash, too, because the same week she got her settlement, she got hit by a hit-and-run driver.

A debt collector cannot call you to collect a debt that’s been dismissed in court.

A debt collector cannot ask for money for a debt you’ve already paid or settled.

A debt collector cannot report a paid-off debt to a credit reporting agency as still being owed.

Like the rest of us, debt collectors must obey the law. If they don’t, they must pay. It’s quite simple.

If you’re getting harassed or troubled for debts you’ve settled, paid, beaten in court, or just don’t owe, you CAN do something about it. And it can be worth your time, too. Just ask my client.