Deciphering Car Sale Contracts, Continued.

If you haven’t read the first part of this article, you should read it here.

Today we look at all that fine print on the back side of your car sale contract, and figure out what it all means.

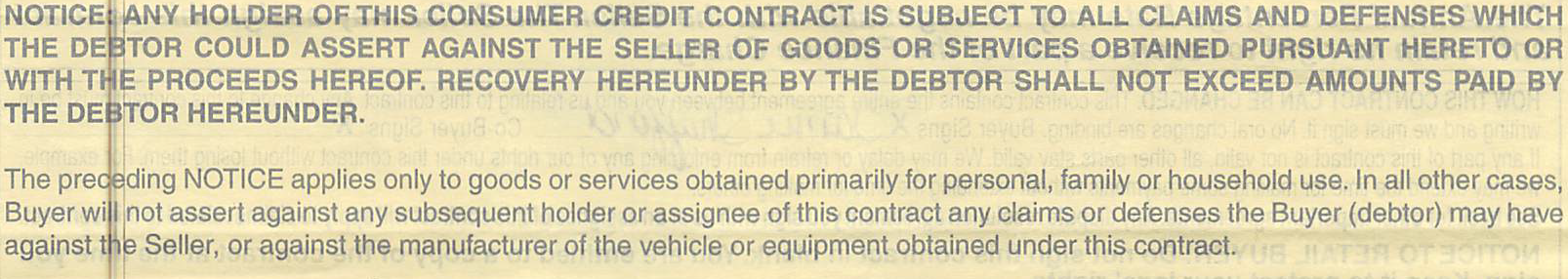

XI. Finance Charge and Payments. Ripoff Rating: 1/10. You promise to make your payments, they charge late fees, they credit your payments to interest first and then principal. What you’d expect. No big deal.

XII. Misc. Promises by You. Ripoff Rating: 2/10. You still have to pay if you crash, lose, or damage the car. You promise not to deliberately abuse the car. You promise not to drive it outside the US or Canada or sell or lease it to someone else. They get a lien on the vehicle and you have to keep it insured against damage – beyond your normal liability insurance. 2 Ripoff points for not letting you drive to Tijuana.

XIII. Default Remedies. Ripoff Rating: 6/10. If you miss a payment or let your insurance lapse, then they can do lots of bad things to you. They can take the car, they can sue you and demand attorneys’ fees as well, they will charge you storage fees for the stuff that was in the car when they repo’d it. They will charge you late fees, they will cancel your service contracts and keep the refund. What is not in here? A grace period. So if your payment is one day late, they can take the car, dump it at auction for a way-too-low price, and sue you for the balance plus court costs and lawyer fees.

XIV. Warranty Disclaimer. Ripoff Rating: 8/10. They do not stand behind their product. In the old days, it was assumed that if a product broke down or didn’t do what it was supposed to do, you could take it back for a refund or replacement. In fact, that’s just what happens if you buy a coffeemaker from Wal-Mart that is malfunctional. But car dealers don’t offer Wal-Mart’s level of customer service.

If the wheels fall off when you drive off the lot, you can’t do anything about it. Even if they swore to you that it was a 1-ton diesel capable of hauling a 36′ Contender to Miami and back. You’re stuck with the lemon. And the lemon law does not apply to used cars. This does not affect manufacturer’s warranties.

XV. Window Sticker Rule. Ripoff Rating: 0/10. The Federal Trade Commission requires all used cars to have a window sticker showing basic info about the vehicle and any warranties that go along with it. The law also requires that sticker’s terms to be part of the contract. Trust me, if it wasn’t required by Big Government Regulation, dealers wouldn’t do it, because that regulation is designed to help you, the buyer, not get screwed.

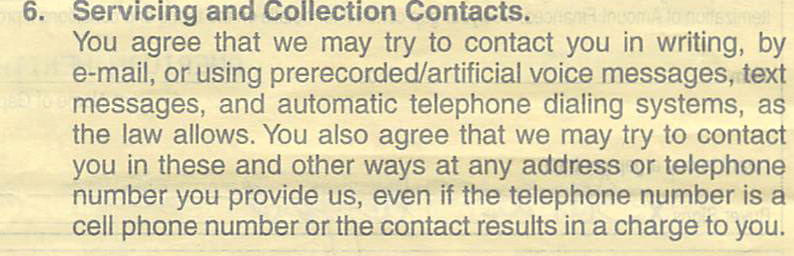

XVI. Robocall Consent. Ripoff Rating: 3/10. They can call you with robotic telephones to annoy you when they want some money.

XVII. Choice of Law Provision. Ripoff Rating: 0/10. Alabama law applies to contracts written in Alabama. Common sense.

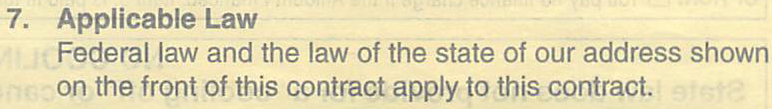

XVIII. Holder Rule Notice. Ripoff Rating: 0/10. When the contract is sold to a finance company, you can sue that finance company for any fraud or breach of contract that the dealer committed. This is to defeat the old common law “holder in due course” doctrine, which was a legal loophole by which a scammer could deceive someone into signing a contract for money payments, then assign that contract and flee to Mexico. The finance company could then pretend to not know about the fraud and sue you for the payments on a fraudulently obtained contract. Today, you can’t do that because dealers have to include the Holder Rule Notice in these contracts. Like most other clauses that provide the buyer with some rights, this one is only in the contract because it is required by a Big Government federal regulation.

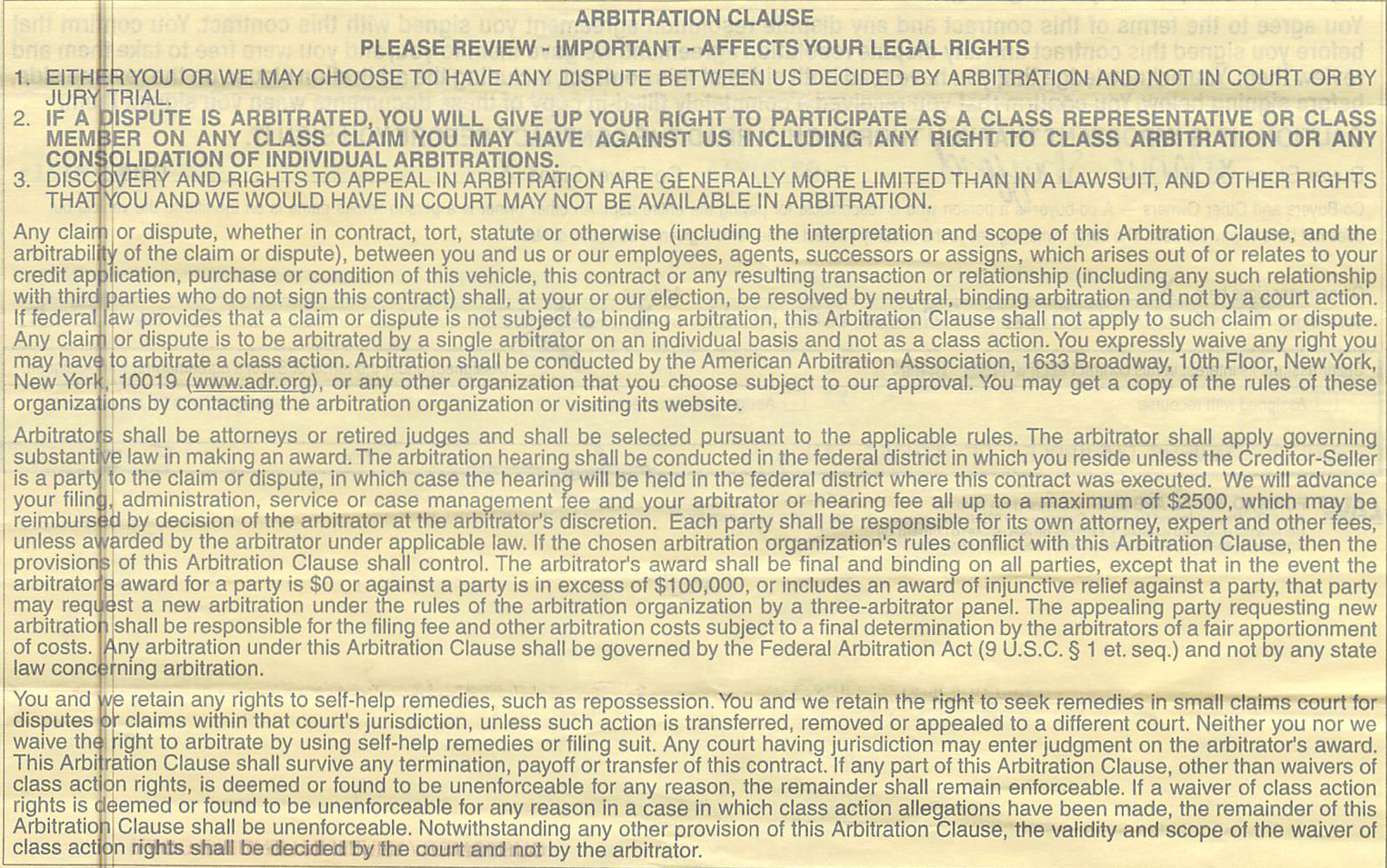

XIV. Arbitration Clause. Ripoff Rating: 10/10. This says that if they deceive you, sell a dangerous product, overcharge you, and steal your money, you can’t take them to court. Instead, you have to go through a private, pseudo-legal proceeding called Arbitration. Your case will be decided by a random corporate lawyer. There is a 90% chance the arbitrator will be an older white male who has spent the past 20 years defending corporations like the one that ripped you off. The rules of evidence don’t apply. You can’t compel them to produce documents or evidence that they don’t want to produce. You can’t make them sit down and tell you their side of the story. No jury. No judge. No appeal if the arbitrator sleeps through the proceeding and then issues a ruling against you that is utterly baseless in the law and ignores all of the evidence. You can’t join up with other people who’ve been similarly ripped off and file a joint lawsuit, or any sort of class action. In other words, no matter how bad or deceitful the dealer’s conduct, and no matter how much you were harmed, your legal remedies are cut in half, if that.

It’s unavoidable nowadays, because the U.S. Supreme Court (even “liberal” justices like Breyer) are mostly former corporate lawyers who’ve never represented an ordinary working person in their entire lives, and they live in a bubble that protects them from having any clue about what life is like for the 99% of us who live in the modern American economy. But that’s life. At least for now. Maybe Trump will lose in 2020 and we’ll have a good president who will get to appoint 3 justices who care about working folks.

As bad as some of these terms are for consumers like you and me, I hope this at least illuminates the nature of these contracts. The more you know, the more you can protect yourself.