If you’ve defaulted on a credit card, how long can the bank wait to sue you?

Believe it or not, this is a surprisingly complex question. In most lawsuits, the statute of limitations is simple. Car wreck cases have to be filed within two years. Ala. Code Sec. 6-2-38(l). So do fraud cases. Ala. Code Sec. 6-2-3 Truth in Lending Act cases have to be filed within one year. 15 U.S.C. Sec. 1640(e).

But credit card cases aren’t so clear. The reason is that credit cards weren’t invented when Alabama’s statutes of limitations were written, so the laws don’t clearly apply. Is it a contract case? An open account? An account stated? The answer is that it depends on what evidence the credit card company has against the consumer.

In Alabama there are three legal theories that could apply to a credit card lawsuit. A contract case is the one that would seem to fit best. If you have entered a written credit card agreement, then a lawsuit to enforce that agreement should be a contract case, right? Yes. But sometimes, the credit card companies can’t produce the original contract, and without it, the rules of evidence don’t allow extraneous evidence of the terms of the contract. So that makes a contract case impossible to win. A contract case has a statute of limitations of six years.

So if they can’t produce any agreement, they can try to sue for what’s called an “Account Stated.”

“An account stated is a post-transaction agreement. It is not founded on the original liability, but is a new agreement between parties to an original account that the statement of the account with the balance struck is correct and that the debtor will pay that amount. It is as if a promissory note had been given for the balance due.” Ayers v. Cavalry SPV I, LLC., 846 So.2d 474 (Ala. Civ. App. 2003).

Basically, if you have a longstanding account with a bank, store, or credit card company, and they send you statements that you either agree to explicitly or implicity by, say, sending payments, then the law can construe that as an account stated. They’ve “stated” a balance due on an “account,” and you haven’t paid it. But sometimes, the bank or debt collector can’t prove that, either. They have to produce evidence that written statements were actually sent to you and you assented to them somehow. If they can’t produce that evidence, they should lose the case. An Account Stated has a limitations period of six years.

If the Account Stated fails, then they can move down to an “Open Account.” Which is basically just an account of some sort that exists and hasn’t been paid. This doesn’t necessarily require a written contract or written statements (though proving a case without statements is difficult, since a credit card company never has a witness who can say, for instance, ‘I saw Jane Doe swipe this card at Target on June 1, 2009.’).

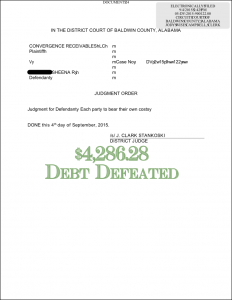

Of the three legal theories, an Open Account is the easiest to prove. But it has a three year statute of limitations. This means that credit card companies and debt collectors often are too late to take advantage of the easiest form of action.

Very recently, the Alabama Legislature has proposed a bill to extend the open account action to six years. This is a bad idea, and would be more generous to credit card companies (and harmful to struggling working folks) than most states.