So you’re doing your recommended once-a-year review of your credit report, and everything looks fine. Then you get to the end, to a section labeled “Inquiries.” And listed there are dozens of companies you’ve never heard of. What? WHO ARE ALL OF THESE PEOPLE LOOKING INTO MY CREDIT???

If you’ve ever felt that way, you’re not alone. I have reviewed a lot of credit reports with a lot of clients. And suffice it to say that a lot of people are shocked and bewildered at the number of inquiries into their credit. And this is not a baseless concern: studies show that the number of “hard” inquiries into your credit have a negative impact on your overall credit rating. What is a “hard” credit inquiry? Generally, any inquiry that is not a “promotional” inquiry only is considered a “hard” inquiry. Promotional inquiries are those inquiries that pop up when, for example, a credit card company pays Experian for a list of all the people in Baldwin County, Alabama who have a credit score of over 600 and mortgage debt of less than $200,000. They use that information to pump your mailbox full of wonderful credit card offers.

A hard inquiry, on the other hand, is a traditional credit inquiry, where a potential creditor looks into your credit for the purpose of evaluating you for a loan, lease, or something like that. Hard inquiries are strictly regulated by the Fair Credit Reporting Act. In theory, at least.

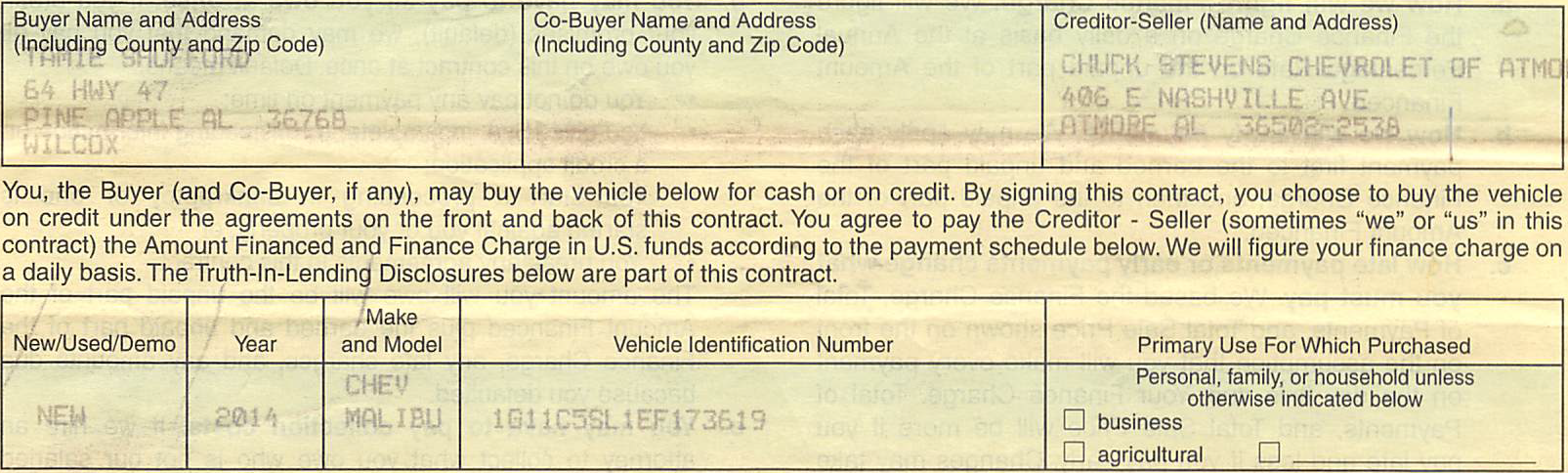

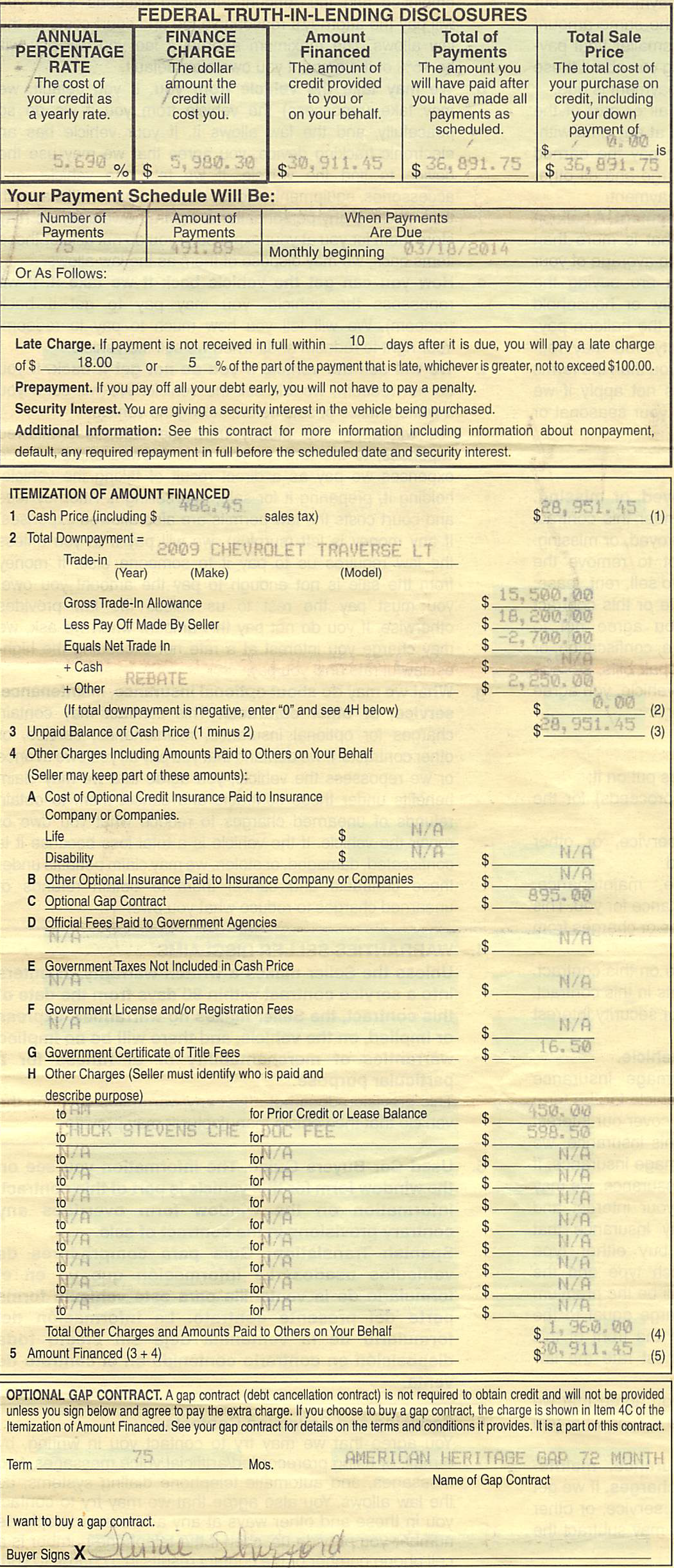

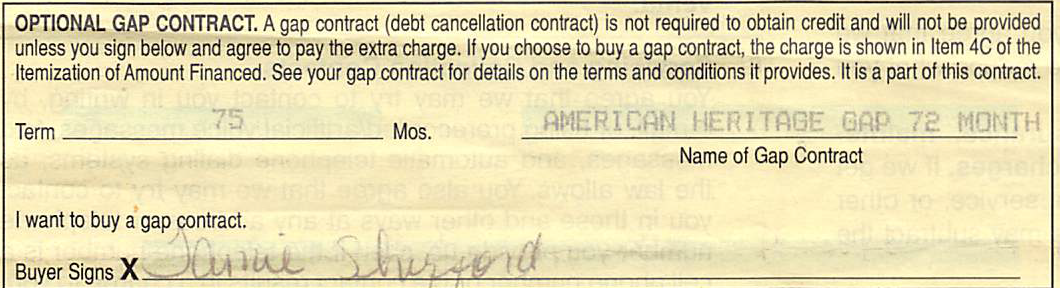

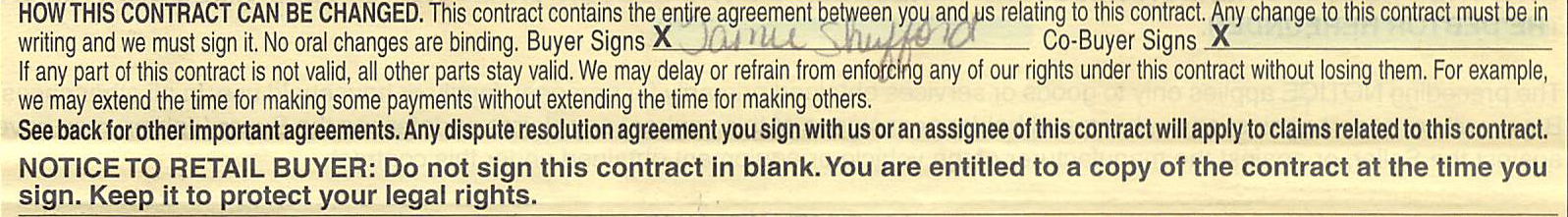

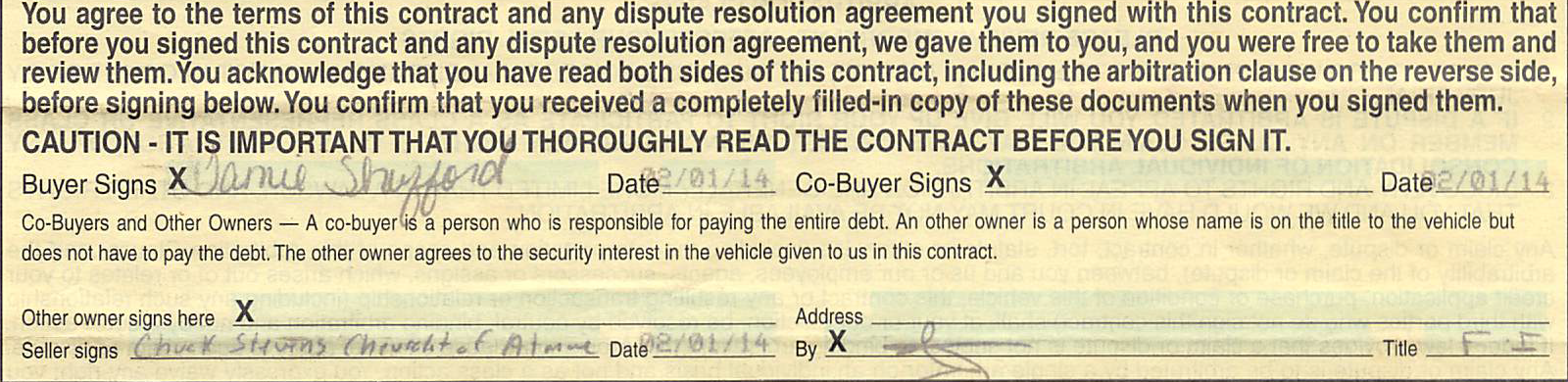

So what can you do about it? Well, first, you need to determine if they are legit or not. Just because you don’t recognize a financial institution listed in your inquiries doesn’t automatically mean something nefarious is going on. So don’t freak out. For instance, if you went car shopping recently, you may have signed a credit application with a car dealership authorizing them to communicate with multiple banks to find you the best deal (or, more cynically, to find them the best deal).

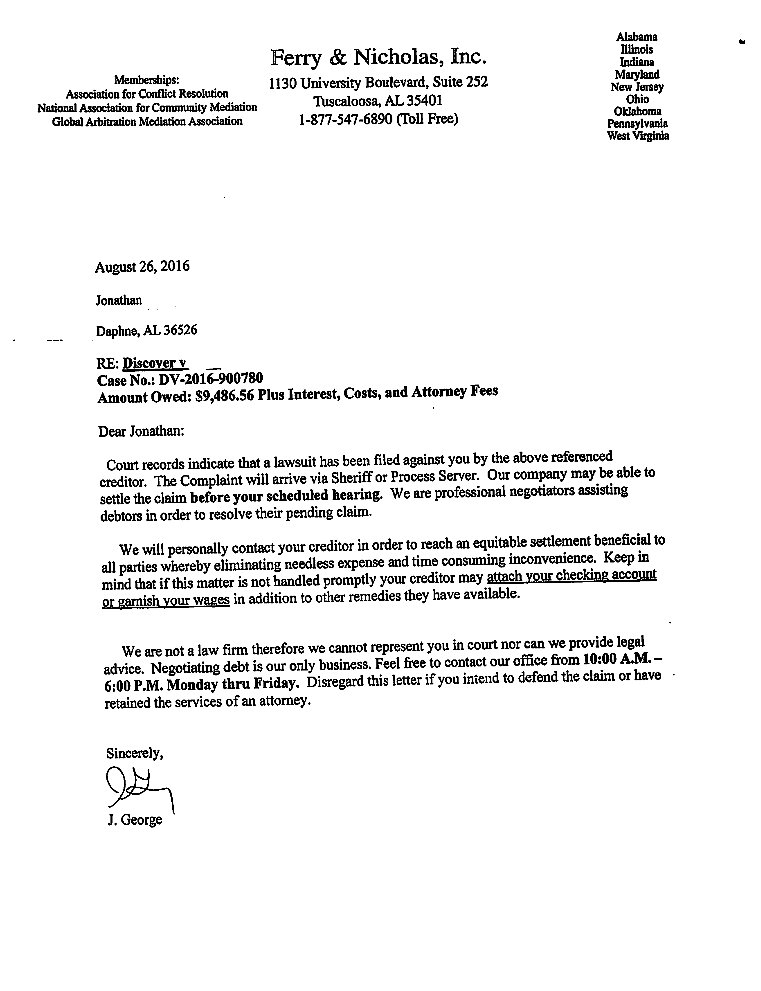

How do you do this? Well, as with so many legal problems, it never hurts to send a nice letter. You can write the financial institution and straight up ask them: Did you receive a credit application from me or someone else on my behalf on April 1, 2020? If so, who sent the credit application? What did you do with it? Was I approved or denied? Also, if you were denied, be sure to ask for a copy of your adverse action notice. If you were denied credit based on a credit report, they are required to tell you so and then you have 60 days to get a free copy of the credit report they used to evaluate your application. If they denied you and didn’t send an adverse action notice, they broke the law. The Equal Credit Opportunity Act prohibits any creditor from holding a credit application for more than 30 days. It also requires them to send you a written notice of denial within 30 days of receiving your application. The denial – called a “adverse action notice” – must also tell you why you were denied.

Why bother with this? Well, there are two reasons. First, if you can determine that any of the inquiries were not authorized by you, then they should be deleted from your report. This could help your credit score a little. Second, the adverse action notices can be helpful in figuring out if you were cheated in the underlying transaction. Let’s say that you went and bought a car, and the dealership told you that the best financing they could find was a $18,000 loan at 22.99% APR and a monthly payment of $443. But when you contact these creditors, you learn that one of them actually APPROVED your application for that very same auto loan – at 16%!!!

If you’re ready to take action and figure out what all those inquiries are about, take a look at my Alabama Consumer Resources Page. There’s a document there that can help you get started.